Forex Compounding Calculator – The Calculating Details Decoded!

Embarking on the forex trading journey is akin to navigating the waves of uncertainty and opportunity in the vast ocean of global finance. Amidst the complexities, one tool stands out as a beacon of financial empowerment: the Forex Compounding Calculator.

A Forex Compounding Calculator computes potential returns over time by reinvesting profits. It helps traders visualize how small gains can accumulate into significant wealth through compounding, aiding informed investment decisions.

Understanding Forex Compounding – The Bird’s Eye View!

When delving into the realm of forex trading, grasping the concept of compounding is paramount. At its core, compounding is reinvesting profits to generate even greater returns over time. Imagine it as a snowball rolling down a hill, gaining momentum with each revolution.

In forex, compounding works similarly. As your trades yield profits, you reinvest them into your trading account instead of withdrawing them. This increases your trading capital, potentially allowing you to earn more with each subsequent trade.

The beauty of compounding lies in its exponential growth potential. Initially, the gains may seem modest. But over time, as your capital grows, so do your profits. It’s like planting a seed and watching it grow into a mighty tree, bearing fruit year after year.

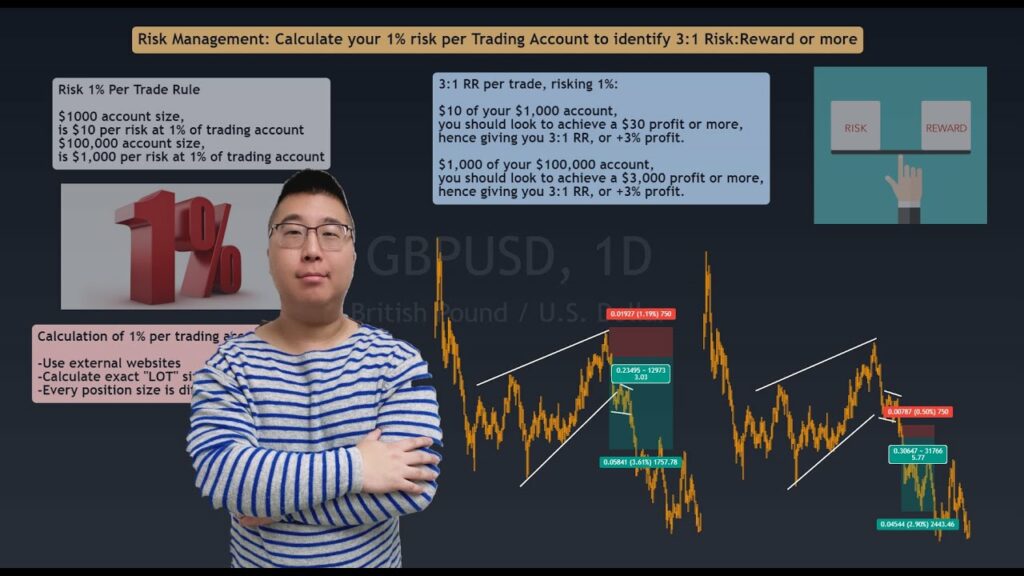

However, compounding has its risks. Just as gains can multiply, so can losses. That’s why exercising caution and employing sound risk management strategies is crucial. Diversifying your trades, setting stop-loss orders, and sticking to a well-thought-out trading plan can help mitigate potential downsides.

How To Use A Forex Compounding Calculator – Learn The Mode Of Action!

Input Initial Investment: Enter the amount you plan to invest initially.

Set Compounding Frequency: Choose how often you want to compound your profits (e.g., daily, weekly, monthly).

Enter Expected Return Rate: Input the average rate of return you anticipate per compounding period.

Calculate Results: Let the calculator crunch the numbers and display your potential earnings over time.

Analyze Results: Review the generated data to understand how your investment grows with compounding.

Read: Fintechzoom Spy Stock Forecast – Everything You Need To Know!

Key Components Of A Forex Compounding Calculator – Uncover!

- Initial Investment: Enter the amount you’re starting with.

- Interest Rate: The fee at which your funding grows.

- Compounding Period: Frequency of reinvesting profits (e.g., daily, weekly).

- Time Horizon: Duration over which you want to calculate returns.

- Additional Contributions: Any extra funds added to the investment over time.

- Graphical Representation: Visualize growth trends for better understanding.

Benefits Of Using A Forex Compounding Calculator – The Importance!

Visualizes Growth Potential:

- Understand how small gains compound into significant wealth over time.

- Gain insights into the power of compounding to motivate disciplined trading.

Strategic Planning Tool:

- Plan and strategize investments for long-term growth.

- Evaluate different scenarios and adjust investment strategies accordingly.

Decision Support System:

- Assess the impact of varying parameters on future returns.

- Make informed decisions based on projected outcomes and risk tolerance.

Motivational Tool:

- Witness potential future wealth, fostering motivation and commitment.

- Stay focused on long-term goals amidst market fluctuations.

Risk Management Aid:

- Evaluate risk-reward ratios and potential losses before making trades.

- Implement risk management strategies effectively to protect capital.

Factors To Consider When Choosing A Forex Compounding Calculator – Must Consider!

1. Accuracy and Reliability:

Ensuring the accuracy of calculations is paramount. Look for a compounding calculator with a proven track record of reliability. Accuracy in projections is crucial for making informed trading decisions and planning your investment strategy effectively.

2. User-Friendliness:

A user-friendly interface is essential for seamless navigation and ease of use. Choose a calculator with intuitive controls and clear instructions. The ability to input data easily and interpret results quickly enhances the overall trading experience and efficiency.

3. Customization Options:

Flexibility in adjusting parameters according to your specific trading preferences is advantageous. Seek a calculator that offers customization options for compounding frequency, initial investment amount, interest rates, and additional contributions. Customization ensures that the calculator aligns with your unique trading goals and strategies.

4. Compatibility and Accessibility:

Ensure that the compounding calculator is compatible with various devices and operating systems. Accessibility across desktops, laptops, tablets, and smartphones enables convenient access to calculations anytime, anywhere. Compatibility ensures that you can monitor your investments and make informed decisions on the go.

5. Feedback and Reviews:

Consider feedback and reviews from other traders and users of the compounding calculator. Assessing user experiences and ratings provides valuable insights into the reliability, performance, and user satisfaction levels of the calculator. Positive feedback and high ratings indicate a trustworthy and effective tool for financial planning and trading.

Tips For Maximizing Profits With A Forex Compounding Calculator – Must Know!

Consistent Reinvestment:

- Regularly reinvest profits to maximize compounding effect.

- Compound interest on a consistent basis accelerates wealth accumulation.

Monitor and Adjust:

- Monitor performance regularly.

- Adjust investment strategies as needed based on market trends and changes.

Diversify Portfolio:

- Spread investments across different currency pairs.

- Diversification reduces exposure to volatility and enhances portfolio stability.

Effective Risk Management:

- Set stop-loss orders to protect capital.

- Adhere to risk management principles to minimize potential losses.

Continuous Learning and Improvement:

- Review past performance to identify strengths and weaknesses.

- Learn from mistakes and successes to refine strategies and improve trading performance.

Examples Of Forex Compounding Calculations – Here For You!

Understanding how forex compounding works through examples can provide clarity and insight into its potential benefits. Consider a scenario where an initial investment of $1,000 is made with an annual interest rate of 5% compounded quarterly.

After the first quarter, the investment grows to $1,012.50. With compounding, the interest for the second quarter is calculated based on this new principal amount, resulting in $1,025.31 at the end of the second quarter. This process continues, and over time, the investment grows exponentially, showcasing the power of compounding in forex trading.

Examining various scenarios and tweaking parameters such as initial investment, interest rates, and compounding frequency can help traders visualize potential outcomes and tailor their investment strategies accordingly.

By utilizing a forex compounding calculator, traders can gain a deeper understanding of how small gains can accumulate into significant wealth over time.

Read: Fintechzoom Best Forex Broker – The Detailed Guide For You!

Common Mistakes To Avoid When Using A Forex Compounding Calculator — Must Get Rid Of!

While forex compounding calculators can be powerful tools for financial planning and decision-making, certain pitfalls should be avoided to ensure accurate projections and optimal results.

One common mistake is neglecting to input accurate data into the calculator. Incorrect figures for initial investment, interest rates, or compounding frequency can lead to flawed projections and misguided trading decisions. Therefore, it’s essential to double-check all input parameters to ensure accuracy and reliability.

Another mistake is overlooking the importance of realistic assumptions and expectations. While compounding can generate substantial returns over time, it’s crucial to maintain a realistic perspective on potential outcomes and avoid overly optimistic projections.

Setting achievable goals and a disciplined trading strategy can help prevent disappointment and frustration in the long run.

Furthermore, failing to regularly review and adjust investment strategies based on changing market conditions can hinder potential growth opportunities. Markets are dynamic and unpredictable, requiring traders to adapt and evolve their approaches accordingly.

By staying informed and flexible, traders can optimize their use of forex compounding calculators and maximize their chances of success in the forex market.

Frequently Asked Questions:

How often should I use a Forex Compounding Calculator?

It’s beneficial to use a Forex Compounding Calculator regularly to assess the impact of different parameters on potential returns and adjust trading strategies accordingly.

Can a Forex Compounding Calculator predict future profits accurately?

While it provides projections based on input parameters, a Forex Compounding Calculator’s accuracy depends on the accuracy of the data input and the assumptions made.

Are there risks associated with using a Forex Compounding Calculator?

The primary risk lies in relying solely on projected outcomes without considering market volatility, changing conditions, or unforeseen events. It’s essential to use calculations as guides rather than guarantees.

Conclusion:

A Forex Compounding Calculator facilitates the computation of potential returns over time by reinvesting profits. Through the compounding process, it enables traders to envision the gradual accumulation of small gains into substantial wealth, thereby supporting informed investment decisions.

Read Also:

- Asset Management In Chattanooga Tennessee – Know In Detail!

- Fintechzoom Best Crypto Exchange – Compiled At One Stop!

- Fintechzoom Msft Stock – The Best Cryptocurrency Guide For You!

- First National Realty Partners Pyramid Scheme – Details to Know Here!

- Fintechzoom Goog Stock – A Comprehensive Guidebook!