Cac40 Fintechzoom – Every Detail You Need to Know in 2024!

Have you ever felt the excitement of tracking the CAC40 index in real time? Well, I have, and let me tell you, it’s a game-changer! Thanks to the CAC40 FintechZoom tool, my investment journey has reached new heights.

The CAC40 FintechZoom tool is my go-to for tracking the French stock market. With live updates and user-friendly features, it’s a game-changer for making informed investment decisions.

Join me as we explore how this tool transformed my investment strategy, and I could do the same for you.

A Brief Introduction to cac40 fintechzoom – Delve in!

Come on a journey of discovery with a concise introduction to the CAC40 FintechZoom. This powerful tool serves as a gateway to the dynamic realm of the French stock market, presenting many capabilities designed to cater to beginners and pro investors.

As we delve into its functionalities, it becomes evident that this user-friendly platform provides a comprehensive solution for staying abreast of the latest market trends and making well-informed investment decisions.

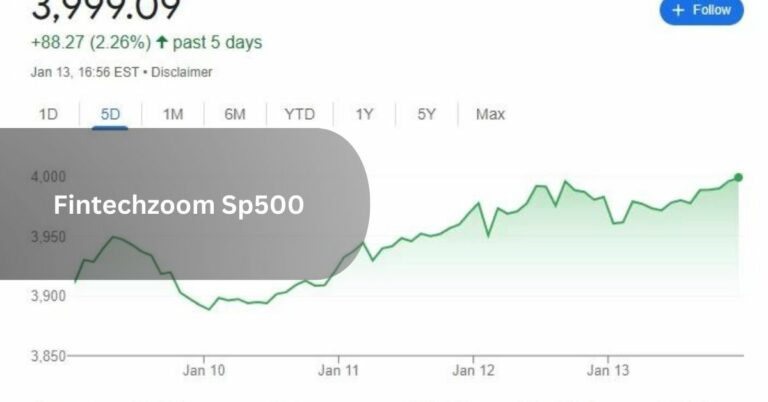

The CAC40 index, the benchmark for the French stock market, consists of the 40 most significant and most actively traded companies listed on the Euronext Paris exchange. The constant fluctuations in the stock market can present challenges, making it crucial for investors to have a reliable tool.

Enter the CAC40 FintechZoom, which eliminates the need for manual calculations and unreliable sources. Through its real-time data and accurate analysis, this tool becomes an indispensable asset in navigating the complexities of the stock market.

Whether you’re a novice eager to understand market dynamics or a seasoned professional seeking efficient ways to optimize your investment strategy, the CAC40 FintechZoom has you covered.

From customizable alerts to interactive charts, it provides a holistic approach, ensuring users have everything they need to make informed decisions and maximize profits. Say farewell to the hassles of tracking the CAC40 index manually and welcome the era of streamlined and efficient market monitoring with the CAC40 FintechZoom tool.

Benefits to Invest In cac40 fintechzoom – Know and Reveal!

1. Diversification and Risk Reduction:

Investing in the CAC40 FintechZoom proves to be a strategic move for those seeking diversification in their investment portfolio. The CAC40 index, representing the 40 largest companies in France, offers a well-rounded exposure to various sectors, including banking, insurance, energy, retail, and technology. This diversity minimizes risk and enhances the potential for returns by tapping into the growth of different industries.

2. Cost-Effectiveness and Accessibility:

One of the significant advantages lies in the cost-effectiveness of investing in the CAC40 FintechZoom. Compared to individually investing in stocks, opting for the index requires minimal effort and is more budget-friendly.

Additionally, the index is regularly updated, providing investors with an accessible and convenient means to monitor their investments. This cost-effective approach allows beginners and seasoned investors to engage with the French stock market efficiently.

3. Access to Top Companies and Market Performance Insights:

Investing in the CAC40 index through FintechZoom provides investors with a gateway to some of the best-performing companies in France. As the index is composed of the largest and most successful entities across various sectors, investors can tap into the potential growth of these industry leaders.

Moreover, the CAC40 FintechZoom tool facilitates a deep understanding of market performance by offering real-time insights, allowing investors to make informed decisions based on the latest trends and developments.

Some Factors that Must Be Considered before Investing with cac40 fintech zoom – Explore With Me!

1. Risk Assessment:

Foremost among the considerations is a thorough evaluation of the associated risks. As with any investment, understanding the potential for loss is crucial. By assessing the market conditions and recognizing the inherent risks, investors can tailor their strategies to mitigate uncertainties and make informed decisions aligned with their risk tolerance.

2. Fees and Investment Vehicle Analysis:

Investors venturing into the CAC40 FintechZoom platform should pay close attention to associated fees. These fees can vary based on the type of investment being pursued and the chosen investment vehicle. Whether opting for Exchange Traded Funds (ETFs), mutual funds, or index funds, a meticulous analysis of fees ensures a clear understanding of the costs involved, allowing investors to optimize their investment strategy.

3. Liquidity Considerations:

The liquidity of the CAC40 Index, comprising the 40 largest companies in France, should also be considered. While the index is relatively liquid, investors must assess whether it aligns with their liquidity preferences. Recognizing the ease with which assets can be bought or sold in the market ensures that investors have flexibility and accessibility in managing their investments.

The procedure to invest in cac40 Fintechzoom – Know in Detail!

Investing in CAC40 FintechZoom becomes a straightforward and well-guided process when one delves into the step-by-step procedures. The first step to initiate this investment journey is to choose a suitable investment vehicle, such as Exchange Traded Funds (ETFs), mutual funds, or index funds.

These investment options serve as channels for investors to gain exposure to the CAC40 index. ETFs, known for their cost-effectiveness, can be easily purchased through a brokerage account, providing a convenient way to track the index’s performance.

Once the investment vehicle is selected, the next step involves understanding the fees associated with investing in the CAC40 index. Different investment options may entail varying fees, and investors must grasp these costs to make informed decisions. This diligent consideration ensures that investors know the financial implications of their chosen investment route.

After addressing the fee structure, investors can monitor the CAC40 index through the chosen investment vehicle. Whether in ETFs, mutual funds, or index funds, keeping a close eye on the index’s daily performance is crucial for making timely and informed decisions.

By understanding the intricacies of the investment process with CAC40 FintechZoom, investors can confidently navigate the financial landscape, ensuring their investment strategy aligns with their financial goals.

Some Strategies To Apply While Investing With Cac40 Fintechzoom!

1. Setting Strategies to Manage Risk:

A paramount strategy when investing with CAC40 FintechZoom is diversification. Investors can effectively mitigate risk by spreading investments across various companies within the CAC40 index. Diversification ensures that one company’s performance does not disproportionately impact the overall investment portfolio.

This strategy enhances resilience, allowing investors to weather fluctuations in individual stock prices while benefiting from the collective growth potential of the diverse companies within the index.

2. Long-Term Investment Approach:

Opting for a long-term investment horizon is a strategic move when leveraging CAC40 FintechZoom. This approach aligns with the inherent stability of the CAC40 index, which consists of the 40 largest companies in France.

By adopting a long-term perspective, investors can ride out short-term market fluctuations and capitalize on the overall growth trajectory of the index. This patient strategy reduces the impact of market volatility and maximizes returns by leveraging the compounding effect over time.

3. Staying Informed and Proactive Decision-Making:

Remaining informed about the performance of the CAC40 index is crucial for effective decision-making. Investors can stay ahead of market trends by utilizing the real-time data and analysis provided by CAC40 FintechZoom.

Regularly monitoring the index’s movements and staying updated on relevant financial news empowers investors to make proactive decisions. Whether adjusting the investment portfolio or seizing opportunities based on emerging market patterns, staying informed is a cornerstone strategy for success when investing with CAC40 FintechZoom.

Also, There Are Some Risks – Avoid These!

1. Market Concentration and Diversification Challenges:

One notable risk associated with investing in the CAC40 index is its market concentration. Comprising the 40 largest companies in France, the index might need more diversification found in broader market indices.

Investors need to be aware that the entire portfolio’s performance is significantly influenced by a limited number of large companies within the index. This concentration amplifies the impact of adverse developments in these key players, emphasizing the importance of implementing additional diversification strategies within one’s overall investment portfolio.

2. Market Value and Financial Factors:

Another risk to be aware of is the inherent market volatility associated with stock investments. External economic factors, geopolitical events, and global market trends can contribute to fluctuations in the CAC40 index.

While volatility presents opportunities, it poses risks, especially for short-term investors. Investors must assess their risk tolerance and investment horizon carefully.

Being mindful of economic indicators and external factors that may influence market movements allows investors to make informed decisions and navigate through periods of heightened volatility with resilience.

3. Fee Considerations and Investment Costs:

Investors should also be attentive to the fees associated with investing in the CAC40 index through various vehicles such as ETFs, mutual funds, or index funds. While the index is a cost-effective investment option, the fees for specific investment vehicles can vary.

Understanding these costs is paramount for investors, as they directly impact their returns. Conducting thorough research on the fee structures associated with different investment options ensures that investors make decisions aligned with their financial goals while avoiding unforeseen financial setbacks.

Frequently Asked Questions:

1. How often is the CAC40 index updated, and why does it matter?

The CAC40 index is updated daily. Regular updates matter because they provide current information on the performance of your investments.

2. What is the long-term strategy for investing with CAC40 FintechZoom?

Adopt a long-term perspective to ride out market fluctuations, aligning with the stability of the CAC40 index and maximizing returns over time.

3. How can I avoid potential risks when investing with CAC40 FintechZoom?

Mitigate risks by diversifying your portfolio, understanding market volatility, and knowing the fees associated with different investment options.

Conclusion:

To keep tabs on the French stock market, I turn to the CAC40 FintechZoom tool. Its real-time updates and user-friendly features have transformed how I make well-informed investment decisions.

Read more: