Fintechzoom Tsla Stock – Explained Thoroughly!

As someone who’s followed the rollercoaster ride of TSLA stock on FintechZoom, I can tell you firsthand that it’s been quite the journey. From exhilarating highs to nerve-wracking lows, investing in Tesla has been thrilling.

TSLA stock on FintechZoom is a rollercoaster ride, with highs and lows. It’s been thrilling and nerve-wracking, but my personal experience has been worth it.

Let me take you through my experience navigating the twists and turns of the TSLA stock on FintechZoom.

Understanding Tsla Stock Fintechzoom – The Brief Introducion!

Investing in TSLA stock through FintechZoom requires a fundamental understanding of Tesla’s business model, market dynamics, and financial performance. Tesla, led by visionary entrepreneur Elon Musk, revolutionizes the automotive industry with its electric vehicles and renewable energy solutions.

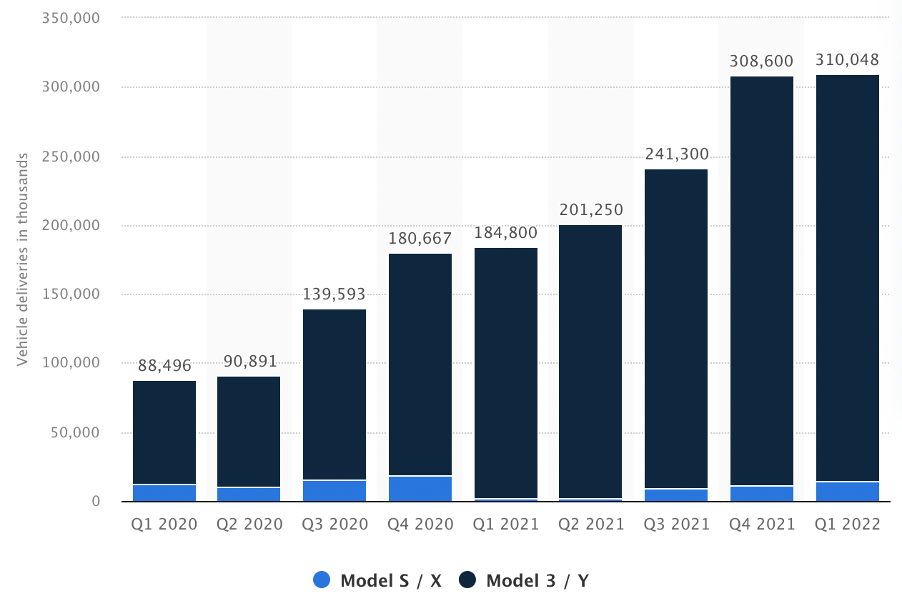

Its innovative approach to sustainable transportation and energy storage has garnered significant attention from investors worldwide. Navigating TSLA stock on FintechZoom involves analyzing Tesla’s quarterly earnings reports, production numbers, and announcements regarding new products and initiatives.

Understanding the company’s competitive landscape, regulatory environment, and technological advancements is crucial for making informed investment decisions. Additionally, keeping track of market sentiment, analyst forecasts, and macroeconomic trends can provide valuable insights into the trajectory of TSLA stock on FintechZoom.

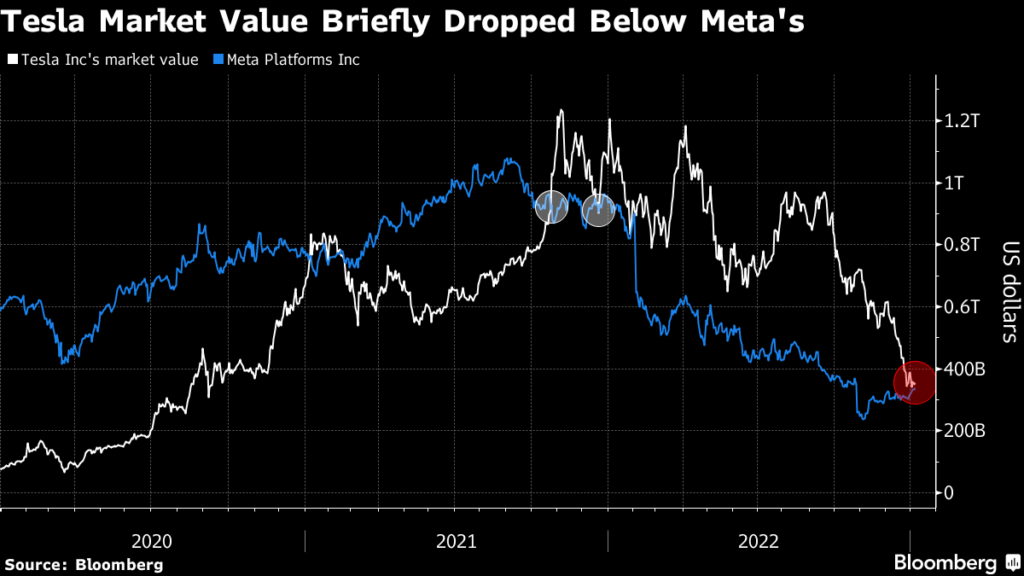

Investors must also consider the inherent volatility and speculative nature of TSLA stock. The stock price often experiences significant fluctuations driven by market speculation, investor sentiment, and external factors.

While TSLA stock presents opportunities for substantial gains, it also carries risks inherent in the stock market. Therefore, a comprehensive understanding of Tesla’s business fundamentals and market dynamics is essential for investors navigating TSLA stock on FintechZoom.

Benefits Of Investing In Tesla Stock Fintechzoom – Explore Now!

Investing in Tesla stock through FintechZoom offers several potential benefits for investors seeking exposure to the electric vehicle and renewable energy sectors. Tesla’s innovative products, strong brand recognition, and ambitious growth strategies position it as a sustainable transportation and energy market leader.

One key benefit of investing in Tesla stock is the company’s disruptive potential and long-term growth prospects. As the shift towards electric vehicles and renewable energy accelerates, Tesla stands to benefit from increasing demand for its products and services.

Additionally, Tesla’s vertically integrated business model, which includes manufacturing, energy storage, and software development, provides diversification and scalability opportunities. Furthermore, investing in Tesla stock allows investors to align their portfolios with environmentally sustainable and socially responsible investments.

Tesla’s commitment to reducing carbon emissions and advancing clean energy solutions resonates with investors seeking to impact the environment and society positively. By investing in Tesla stock through FintechZoom, investors can support the transition towards a more sustainable future while potentially realizing attractive financial returns.

Factors Influencing Tesla Stock Price In Fintechzoom – Know Now!

Understanding the various factors that influence TSLA stock price on FintechZoom is essential for investors navigating the dynamic landscape of the stock market. Several key factors can impact the trajectory of TSLA stock, including Tesla’s financial performance, industry trends, regulatory developments, and market sentiment.

Tesla’s quarterly earnings reports and delivery numbers often catalyze movements in TSLA stock price on FintechZoom. Positive earnings surprises, robust vehicle deliveries, and progress on critical initiatives can fuel investor optimism and drive TSLA stock higher. Conversely, missed targets or operational challenges may lead to downward pressure on TSLA stock price.

Moreover, macroeconomic factors such as interest rates, inflation, and geopolitical events can influence TSLA stock prices on FintechZoom. Changes in consumer sentiment, technological advancements, and competitor actions can further impact investor perceptions of Tesla’s growth prospects and competitive positioning.

In addition to internal and external factors, investor sentiment and market psychology play a significant role in determining TSLA stock price on FintechZoom. News headlines, social media chatter, and analyst reports can influence investor sentiment and contribute to short-term fluctuations in TSLA stock prices.

Overall, navigating the complexities of TSLA stock price on FintechZoom requires a comprehensive understanding of the interplay between fundamental factors, market dynamics, and investor behaviour. By staying informed and disciplined in their investment approach, investors can position themselves to capitalize on opportunities and mitigate risks in the ever-changing landscape of the stock market.

Investing In Tesla Stock – Stay Alert!

Investing in TSLA stock can be exciting and daunting for beginners and seasoned investors. Understanding effective strategies and potential risks and rewards is essential for making informed investment decisions in the dynamic world of TSLA stock.

Strategies For Investing In Tesla Stock:

When investing in TSLA stock, developing a sound investment strategy tailored to your financial goals, risk tolerance, and investment horizon is crucial. Some investors opt for a long-term buy-and-hold approach, believing in Tesla’s disruptive potential and long-term growth prospects.

Others may prefer a more active trading strategy, capitalizing on short-term price fluctuations and market trends. Regardless of your approach, conducting thorough research, diversifying your portfolio, and staying disciplined are vital principles for successful TSLA stock investing.

Additionally, considering factors such as Tesla’s financial performance, competitive positioning, and industry trends can help inform investment decisions. Monitoring market sentiment, analyst recommendations, and macroeconomic indicators can provide valuable insights into the broader market environment and potential opportunities or risks associated with TSLA stock.

Risks And Rewards Of Tesla Stock Investment:

Investing in TSLA stock offers the potential for significant rewards, but it also carries inherent risks that investors must carefully consider. Tesla operates in a highly competitive and rapidly evolving industry, facing challenges such as production constraints, regulatory scrutiny, and technological disruptions.

As a result, TSLA stock prices can be volatile, subject to sudden fluctuations driven by market sentiment and external factors. Moreover, investing in individual stocks like TSLA entails company-specific risks, including management changes, supply chain disruptions, and legal or regulatory issues.

While Tesla’s innovative products and ambitious growth strategies have propelled its success, investors should remain vigilant and aware of potential downside risks associated with TSLA stock investment.

Despite these risks, investing in TSLA stock can reward investors with a long-term perspective and a diversified portfolio. Tesla’s groundbreaking technologies, strong brand recognition, and global market expansion efforts position it as a leader in the electric vehicle and renewable energy sectors.

By carefully assessing risks and staying informed, investors can capitalize on opportunities TSLA stock presents while managing downside risks effectively.

Actionable Steps – Dive In!

Take Control Of Your Tesla Investments:

To take control of your TSLA investments, consider implementing strategies to stay informed, manage risk, and optimize your investment portfolio.

Start Investing In Tsla Today:

If you’re considering investing in TSLA, taking action today can help you capitalize on potential opportunities and position your portfolio for long-term growth.

Join The Tesla Stock Community:

Joining the TSLA stock community can provide valuable insights, support, and resources to enhance investment knowledge and decision-making. Connecting with fellow investors and industry experts lets you stay updated on the latest developments and trends impacting TSLA stock and the broader market landscape.

Frequently Asked Questions:

Is TSLA stock a good investment?

It depends on your financial goals and risk tolerance. Some investors believe in Tesla’s potential for growth, while others are cautious due to its volatility.

What factors influence the price of TSLA stock?

Factors like Tesla’s earnings reports, market trends, and news about the company can influence the price of TSLA stock.

What are the risks of investing in TSLA stock?

Risks include market volatility, competition, and regulatory challenges affecting Tesla’s business and stock price.

Can I make money by investing in TSLA stock?

Yes, investors can make money if the price of TSLA stock increases after they buy it, but there are no guarantees.

Should I invest in TSLA stock for the long term?

Investing in TSLA stock long-term can be a good strategy if you believe in Tesla’s future growth prospects and are willing to hold onto your investment through market fluctuations.

Conclusion:

Investing in TSLA stock via FintechZoom has been quite the journey, marked by ups and downs. While the experience has been exhilarating and, at times, stressful, it has been rewarding overall from my perspective.

Read Also: