Ge Stock Fintechzoom – 2024 Guide For Investors!

As a passionate investor who’s closely followed GE stock through the lens of FintechZoom, I’ve learned that the journey of investing isn’t just about numbers but the stories behind them.

With FintechZoom as my trusted guide, I’ve navigated the highs and lows, gaining insights beyond the headlines. Let me take you on a journey where GE stock meets the world of FintechZoom, where data meets experience, and where every trade tells a tale.

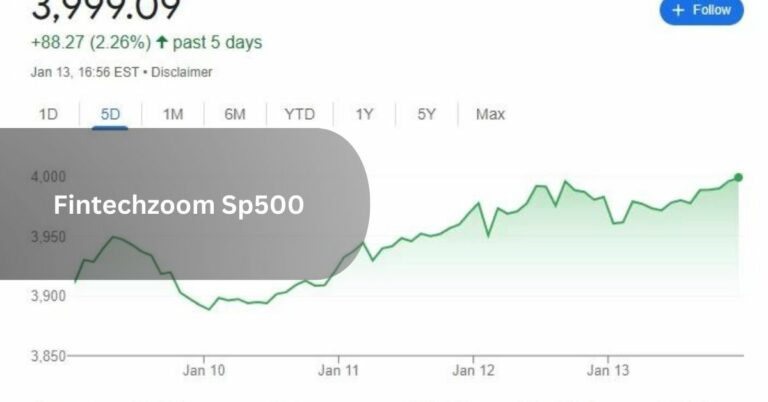

GE stock on FintechZoom offers insights for investors. Follow trends, analyze data, and make informed decisions on Ge stock on fintech Zoom for the most successful investment ever.

Overview of GE Stock Performance – A Bird’s Eye View!

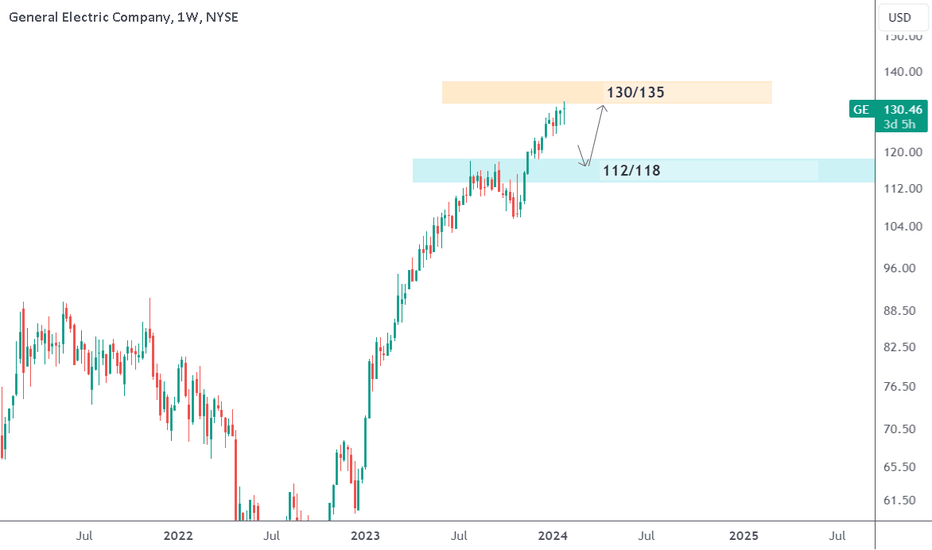

GE stock has been a subject of interest among investors for its fluctuating performance in recent times. Over the past year, GE has witnessed both highs and lows in its stock price, reflecting the dynamic nature of the market.

Despite facing challenges, GE has shown resilience, with its stock price responding to company earnings reports, industry trends, and macroeconomic conditions.

In the past quarter, GE’s stock experienced a notable uptick following positive news regarding its restructuring efforts and strategic initiatives. However, fluctuations in global economic conditions and geopolitical tensions have also influenced GE’s stock performance, highlighting the interconnectedness of the market.

Investors track GE stock and closely monitor vital indicators such as revenue growth, profit margins, and debt levels to assess the company’s financial health and prospects.

FintechZoom’s Coverage of GE Stock – What You Need to Know!

FintechZoom provides comprehensive coverage of GE stock, offering investors valuable insights and analysis to navigate the complexities of the market. Through in-depth articles, real-time updates, and expert commentary, FintechZoom informs investors about the latest developments impacting GE’s stock performance.

Whether it’s breaking news, earnings reports, or industry trends, FintechZoom delivers timely information to help investors make informed decisions.

Moreover, FintechZoom’s user-friendly interface and intuitive tools empower investors to delve deeper into GE’s stock performance, enabling them to track historical data, conduct comparative analysis, and identify potential investment opportunities.

With FintechZoom’s robust platform, investors can stay ahead of the curve, gaining a competitive edge in today’s fast-paced market environment. From novice traders to seasoned professionals, FintechZoom caters to investors of all levels, fostering a community driven by knowledge, insight, and collaboration.

Analyzing GE’s Financial Health and Market Position – Track Separately!

Financial Power:

General Electric’s financial health is a reflection of its overall stability and performance in the market. Understanding vital financial metrics can provide valuable insights for investors. One crucial indicator is revenue, which reflects the company’s total operating income.

In recent years, GE has undergone strategic transformations to enhance its revenue streams, diversifying across aviation, healthcare, and renewable energy industries. Analyzing revenue trends over time can reveal patterns of growth or decline, indicating the company’s trajectory.

Another vital aspect is profitability, measured by net income and operating margin metrics. After accounting for expenses and taxes, net income represents the company’s bottom line. Operating margin, on the other hand, shows the percentage of revenue that translates into profit. For GE, improving profitability has been a focus amidst restructuring efforts and cost-cutting initiatives.

By analyzing these financial indicators alongside market trends and industry dynamics, investors can understand GE’s financial health and potential for future growth.

Market Positioning:

GE’s market position encompasses its competitive standing within various industries and its ability to capture market share. A key element in evaluating market position is assessing the company’s product portfolio and innovation strategies.

GE’s diverse portfolio spans technology, healthcare, energy, and aviation, positioning it as a significant player in global markets. By continually innovating and adapting to evolving consumer demands, GE strives to maintain its competitive edge and capitalize on emerging opportunities.

Furthermore, assessing GE’s market position involves analyzing its brand reputation and customer relationships. A strong brand presence can enhance customer loyalty and attract new business opportunities. GE aims to solidify its position as a trusted provider of innovative solutions through strategic partnerships and customer-centric initiatives.

Key Factors Influencing GE Stock Price Movements – Must Consider!

Economic Indicators and Global Trends

Broader economic indicators and global trends influence the stock price of General Electric (GE). Economic factors such as GDP growth, inflation, and interest rates can impact GE’s operations and, consequently, its stock price.

Global trends in industries where GE operates, like aviation and renewable energy, can also influence investor sentiment and stock movements. Understanding the economic landscape and staying abreast of global developments is crucial for anticipating how these factors may impact GE stock.

Company Performance and Financial Results

The financial performance of GE directly affects its stock price. Investors closely scrutinize quarterly and annual financial reports, focusing on metrics such as revenue, net income, and operating margins.

Positive financial results often increase investor confidence, driving stock prices higher. Conversely, disappointing performance can lead to a decline in stock value. Monitoring key economic indicators provides insights into the company’s overall health and potential for sustained growth.

Regulatory and Policy Changes

Government regulations and policies can significantly impact GE’s operations and, consequently, its stock price. Changes in energy, healthcare, and aviation industry laws can directly affect GE. For instance, new environmental policies may boost demand for GE’s renewable energy solutions.

Conversely, regulatory challenges can pose risks. Investors should stay informed about legislative developments and their potential effects on GE’s business and stock performance.

Technological Innovations and Industry Disruptions

The technology landscape and industry disruptions are vital in shaping GE’s stock movements. Advancements in technology can enhance the competitiveness of GE’s products, driving stock prices higher.

Conversely, disruptions in traditional industries or failure to adapt to technological changes can negatively impact GE’s stock. Investors should monitor technological innovations and industry trends to anticipate how these factors may influence GE’s competitive position and stock performance.

Investor Sentiment and Market Speculation

The psychological aspect of investing, often driven by investor sentiment and market speculation, can cause fluctuations in GE’s stock price. Joyous news, market rumors, or sentiment shifts can lead to sudden price movements.

Understanding market sentiment and distinguishing it from fundamental factors is crucial for investors. Analyzing news, social media, and market sentiment indicators can provide insights into potential short-term movements in GE stock prices.

Tracking GE’s Presence in the FintechZoom Universe – Know the Record!

FintechZoom provides a wealth of information and analysis on GE stock, making it essential for investors to track GE’s presence in this financial universe. FintechZoom offers real-time updates, expert opinions, and comprehensive data on GE’s stock performance, informing investors about market trends and potential opportunities.

By monitoring GE’s coverage on FintechZoom, investors can gain valuable insights into factors influencing GE’s stock price, such as earnings reports, industry developments, and analyst recommendations.

FintechZoom’s user-friendly interface and customizable features also empower investors to tailor their research and analysis according to their investment goals and preferences. Tracking GE’s presence in the FintechZoom universe is a strategic tool for investors seeking to make informed decisions and stay ahead in the dynamic world of stock trading.

Tips for Investing in GE Stock Wisely – Focus on These Tricks!

Investing in GE stock requires careful consideration and strategic planning to maximize returns and mitigate risks.

One essential tip for investors is to conduct thorough research and analysis before making investment decisions. By understanding GE’s business model, financial health, and competitive position, investors can assess its long-term prospects and make informed investment choices.

Additionally, diversification is critical to managing risk in the stock market. While GE may present attractive investment opportunities, spreading investments across various asset classes and industries can help reduce exposure to company-specific risks.

Furthermore, staying disciplined and avoiding emotional decision-making is crucial for successful investing. By setting clear investment goals, adhering to a diversified portfolio strategy, and remaining patient during market fluctuations, investors can navigate the complexities of investing in GE stock wisely and achieve their financial objectives.

Utilizing FintechZoom Data to Inform Your GE Stock Investment Strategy – Guide For You!

FintechZoom data is valuable for investors seeking to develop and refine their GE stock investment strategy. FintechZoom offers various analytical tools, charts, and market insights to help investors assess GE’s performance and identify potential investment opportunities.

Utilizing FintechZoom data allows investors to track key metrics such as stock price movements, trading volume, and analyst ratings, enabling them to make data-driven decisions based on real-time information.

Moreover, FintechZoom’s comprehensive coverage of GE stock gives investors expert analysis and commentary, helping them gain deeper insights into market trends and dynamics.

By leveraging FintechZoom data effectively, investors can develop a well-informed investment strategy tailored to their risk tolerance and financial objectives, ultimately maximizing their chances of success in the competitive world of stock trading.

GE Stock – Past Trends and Future Prospects!

Understanding GE stock’s past trends and prospects is essential for investors to make informed investment decisions. Analyzing historical data can provide valuable insights into GE’s performance, including price fluctuations, earnings growth, and dividend payouts.

Investors can identify patterns and potential indicators of future stock movements by examining past trends, helping them anticipate market trends and adjust their investment strategies accordingly.

Furthermore, evaluating GE’s prospects involves assessing its competitive position, industry trends, and growth opportunities. GE’s strategic initiatives, such as digital transformation and portfolio optimization, can influence its future performance and stock valuation.

By staying informed about GE’s business strategies and industry developments, investors can position themselves to capitalize on potential growth opportunities and navigate challenges in the dynamic market environment.

Understanding GE stock’s historical trajectory and future outlook is essential for building a well-rounded investment strategy and achieving long-term financial success.

Frequently Asked Questions:

Is investing in GE stock risky?

Like any investment, investing in GE stock carries risks. Market volatility, industry challenges, and company-specific issues can affect stock performance. Diversifying your investment portfolio and conducting thorough research can help manage risks.

How can I track GE stock performance?

You can track GE stock performance through various financial websites, stock market apps, and brokerage platforms. These platforms provide real-time stock quotes, historical data, and analysis tools to help you monitor GE’s stock price movements.

What are the potential benefits of investing in GE stock?

Investing in GE stock can offer potential benefits such as capital appreciation, dividend income, and exposure to diversified business segments. Additionally, successful investment in GE stock can contribute to long-term wealth accumulation.

In a Nutshell:

The power of GE stock insights on FintechZoom for your most successful investment journey yet. Stay ahead by tracking trends, analyzing data, and making informed decisions with GE stock on FintechZoom.

Read Also: