Fintechzoom Loan Calculator – Get The Loan Now!

Have you ever scratched your head over loan calculations to determine the best repayment plan? I know the feeling all too well. As someone who’s navigated the labyrinth of loans, I understand the importance of clarity and simplicity in financial tools. Enter Fintechzoom Loan Calculator – my trusted sidekick in demystifying loan repayments.

Fintechzoom Loan Calculator simplifies loan repayments by crunching numbers for you. Just enter your loan amount, interest rate, and term to get instant clarity on your payments. Easy peasy!

This is a brief introduction to the Fintechzoom loan calculator. Explore it in detail!

The Fintechzoom Loan Calculator is a powerful tool designed to simplify the complex world of loans. Whether considering a mortgage, car loan, or personal loan, this calculator lets you make informed financial decisions quickly.

At its core, the Fintechzoom Loan Calculator operates straightforwardly: input your loan amount, interest rate, and term, and let the calculator do the heavy lifting. With just a few clicks, you gain access to a wealth of information about your loan, including monthly payments, total interest paid, and the overall cost of borrowing.

One of the key benefits of the Fintechzoom Loan Calculator is its versatility. It accommodates various loan types and parameters, allowing you to tailor your calculations to your needs. Whether comparing loan options, planning for future payments, or simply seeking clarity on your financial obligations, this tool is a reliable companion every step of the way.

Moreover, the Fintechzoom Loan Calculator is incredibly user-friendly. Its intuitive interface makes it accessible to individuals of all financial backgrounds, from seasoned investors to first-time borrowers. You don’t need a degree in finance to navigate this tool – just a basic understanding of your loan terms and a willingness to explore your options.

Read Fintechzoom Life Insurance – Secure Your Life!

Critical Benefits Of Uding The Fintechzoom Loan Calculator – Dive In!

Accuracy And Reliability:

The Fintechzoom Loan Calculator stands out for its accuracy and reliability. Its robust algorithms ensure precise calculations, giving users confidence in the results. Whether you’re estimating monthly payments or projecting total interest, you can trust the accuracy of the figures provided by this tool. With reliable information, you can make sound financial decisions and plan for the future with greater certainty.

Time And Cost Saving:

Using the Fintechzoom Loan Calculator saves both time and money. Instead of manually crunching numbers or relying on estimations, this tool provides instant calculations at your fingertips. Streamlining the process eliminates the need for tedious manual calculations and minimizes the risk of errors. Additionally, by clarifying loan terms and repayment schedules upfront, you can avoid costly surprises, ultimately saving you time and money in the long run.

Financial Planning:

The Fintechzoom Loan Calculator serves as a valuable tool for financial planning. Whether you’re considering taking out a loan or already have existing obligations, this calculator helps you precisely map out your financial future. You can develop a strategic plan that aligns with your long-term goals by inputting different loan scenarios and exploring various repayment options. Whether you’re aiming to pay off debt faster or optimize your budget, the insights provided by this tool empower you to make informed decisions and take control of your financial destiny.

Improved Decision Making:

One of the key benefits of using the Fintechzoom Loan Calculator is its ability to enhance decision-making. By providing comprehensive loan information in a clear and accessible format, this tool equips users with the knowledge they need to make informed choices. Whether you’re comparing loan offers, evaluating refinancing options, or assessing the affordability of a major purchase, the insights generated by this calculator enable you to weigh your options and choose the best course of action. With improved decision-making capabilities, you can navigate the complexities of borrowing confidently and clearly.

A Complete Guide On How To Use Fintechzoom Loan Calculator – Know Step By Step!

Visit Fintechzoom Website:

To begin using the Fintechzoom Loan Calculator, visit the official Fintechzoom website. Navigate to the financial tools or loan calculator section to access the tool.

Enter The Loan Amount:

Once on the Fintechzoom Loan Calculator page, enter the loan amount you are considering. This is the principal amount you wish to borrow from a lender.

Specify The Loan Type:

Next, specify the type of loan you are interested in. Select the appropriate option from the dropdown menu, whether it’s a mortgage, car loan, personal loan singapore, or any other type of financing.

Add The Interest Rate:

After specifying the loan type, input the interest rate associated with the loan. This price can be constant or variable, depending on the phrases of your mortgage agreement.

Add Down Payment:

If you’re making a down payment towards the loan amount, enter the down payment amount into the designated field. This initial payment you make upfront reduces the total loan amount.

Then Click To “Calculate”:

Once you have entered all the necessary information, click the “Calculate” button to generate the results. The Fintechzoom Loan Calculator will process the data you provided and display critical details such as monthly payments, total interest paid, and the overall cost of borrowing. This information empowers you to make informed decisions regarding your loan options.

Components Of Loan Calculator – Here To Know!

Principal Amount:

The principal amount is the initial sum borrowed from a lender, excluding interest or additional fees. It represents the core amount that must be repaid for the loan term.

Interest Rate:

The interest rate is the percentage of the principal amount the lender charges for the privilege of borrowing money. It is a critical factor in determining the total cost of the loan and directly impacts the monthly payments.

Loan Term:

The loan term, also known as the loan duration, is the period the loan agreement extends. It specifies the length of time borrowers have to repay the loan, typically expressed in months or years.

Monthly Payment:

The monthly payment, also called the installment, is the fixed amount the borrower pays to the lender at regular intervals, usually monthly. It includes both principal and interest portions of the loan repayment.

Total Interest Paid:

The total interest paid is the cumulative amount of interest accrued over the entire term of the loan. The principal amount, the interest rate, and the loan duration determine it. Understanding the total interest paid provides insights into the overall cost of borrowing.

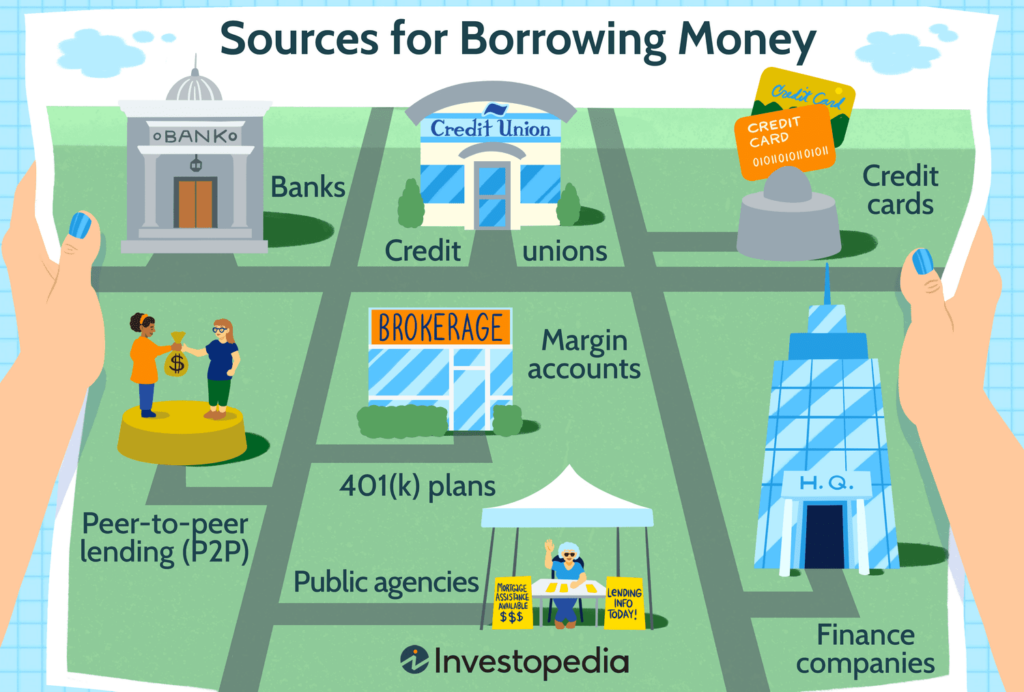

Types Of Loans Offered – Explore Variety!

Mortgages:

Mortgages are loans specifically designed for purchasing real estate properties. They typically have long terms, often spanning 15 to 30 years, and are secured by the purchased property. Mortgages come in various types, including fixed-rate and adjustable-rate mortgages, each offering different terms and interest rates.

Personal Loans:

Personal loans are unsecured loans that individuals can use for various purposes, such as debt consolidation, home improvements, or unexpected expenses. These loans typically have fixed interest rates and terms ranging from a few months to several years.

Auto Loans:

Auto loans are loans used to finance the purchase of a vehicle. They can be secured or unsecured, with the vehicle as collateral for secured loans. Auto loans often have fixed interest rates and terms ranging from 24 to 84 months, depending on the lender and borrower’s preferences.

Student Loans:

Student loans are designed to help students cover higher education expenses, including tuition, fees, books, and living expenses. They come in two main types: federal student loans, which the government funds, and private student loans, which banks and other private lenders offer. Student loans may have fixed or variable interest rates and offer various repayment options.

Business Loans:

Business loans are loans specifically designed to meet the financial needs of businesses. They can be used for various purposes, including startup costs, expansion, equipment purchases, and working capital. Business loans come in different forms, such as term loans, lines of credit, and SBA loans, each tailored to meet the specific needs of different types of businesses.

Read Dow Jones Fintechzoom Today – Know Everything That You Need!

Frequently Asked Questions:

What is the purpose of a loan calculator?

The purpose of a loan calculator is to provide borrowers with insight into their potential loan payments, helping them make informed financial decisions.

Can a loan calculator tell me my exact payments?

While a loan calculator can give you a close estimate, your actual payments may vary based on factors like fees and additional charges from lenders.

Are loan calculators accurate?

Loan calculators provide estimates based on your input information but may not account for all variables. Actual loan terms may differ.

Why should I use a loan calculator?

Using a loan calculator allows you to compare different loan options, understand your financial commitments, and plan for your budget effectively.

Conclusion:

The Fintechzoom Loan Calculator makes loan repayments easier by doing the math for you. Just input your loan amount, interest rate, and term to understand your payment details quickly.

Read Also: