Asset Management In Chattanooga Tennessee – Know In Detail!

Welcome to the heart of Tennessee’s financial landscape, where the scenic city of Chattanooga thrives amidst the Appalachian foothills. A crucial pillar of economic stability lies within its vibrant community: asset management.

As we delve into the dynamic world of wealth preservation and growth, let’s uncover the nuances of asset management in Chattanooga, where expertise meets Southern charm to sculpt financial success stories.

Asset management in Chattanooga, Tennessee, involves overseeing investments, optimising portfolios, and preserving wealth. It encompasses diverse financial strategies tailored to clients’ goals offered by firms within Chattanooga’s economic ecosystem.

What Is Asset Management? – The Brief Introduction!

Asset management oversees a person’s or entity’s investments to maximise returns while mitigating risks. It involves a range of financial instruments such as stocks, bonds, real estate, and commodities.

The primary goal of asset management is to grow wealth over time through strategic allocation and diversification of assets. Asset managers assess the client’s financial objectives, risk tolerance, and investment horizon to develop personalised investment strategies.

Within the realm of asset management, professionals utilise various tools and techniques. These include fundamental and technical analysis to evaluate investment opportunities, portfolio optimisation to balance risk and return, and ongoing monitoring and adjustment to adapt to changing market conditions.

Moreover, asset management firms in Chattanooga, Tennessee, are pivotal in guiding individuals, families, and businesses towards their financial goals. They offer expertise in asset allocation, investment selection, and wealth preservation, tailored to client’s unique needs within the Chattanooga community.

Individuals and organisations can build and safeguard their financial futures through effective asset management strategies.

Read: Fintechzoom Goog Stock – A Comprehensive Guidebook!

Critical Benefits Of Adopting Asset Management In Chattanooga – Compiled For You!

Wealth Preservation:

Asset management in Chattanooga empowers individuals and businesses to safeguard their wealth against market volatility and economic uncertainties. Asset managers help preserve capital over the long term by diversifying investments and implementing risk management strategies.

Customised Financial Strategies:

Asset management firms in Chattanooga offer personalised financial strategies tailored to each client’s unique goals, risk tolerance, and financial situation. Whether it’s retirement planning, wealth accumulation, or estate management, customised solutions ensure that every aspect of a client’s financial journey is accounted for.

Professional Expertise:

By partnering with asset management professionals in Chattanooga, clients gain access to expertise and experience. These professionals possess in-depth knowledge of financial markets, investment products, and regulatory requirements, enabling them to make informed decisions and optimise investment outcomes.

Optimised Portfolio Performance:

Asset managers in Chattanooga employ sophisticated portfolio management techniques to optimise investment performance. Through diligent analysis, asset allocation, and rebalancing, they strive to achieve optimal risk-adjusted returns aligned with clients’ investment objectives.

Financial Peace of Mind:

Adopting asset management services in Chattanooga provides clients with peace of mind, knowing that their financial affairs are in capable hands.

By delegating investment responsibilities to skilled professionals, individuals and businesses can focus on their core activities while having confidence in their financial future.

How Do You Know If You Need An Asset Management Firm In Chattanooga? – Learn Here!

Determining whether you need an asset management firm in Chattanooga depends on various factors related to your financial situation, goals, and preferences. Here are some indicators that may suggest the need for professional asset management services:

Complex Financial Goals: If you have complex financial goals such as retirement planning, wealth preservation, tax optimisation, or estate planning, seeking the expertise of an asset management firm can be beneficial. These firms have the knowledge and resources to develop comprehensive strategies tailored to your needs.

Lack of Time or Expertise: Managing investments requires time, effort, and expertise. If you lack the time or knowledge to effectively manage your assets, partnering with an asset management firm can relieve the burden. They have dedicated professionals who stay abreast of market trends, investment opportunities, and regulatory changes to make informed decisions on your behalf.

Desire for Diversification: Diversification is critical to managing investment risk and enhancing long-term returns. Suppose you have a concentrated portfolio or limited investment options. In that case, an asset management firm can help diversify your holdings across different asset classes, sectors, and geographic regions to mitigate risk and enhance portfolio performance.

Need for Financial Guidance: Uncertain market conditions and changing economic landscapes can make it challenging to navigate investment decisions. Asset management firms provide ongoing financial guidance and support, helping you stay disciplined and focused on your long-term objectives amidst market volatility and fluctuations.

Desire for Peace of Mind: Entrusting your investments to a reputable asset management firm can provide peace of mind, knowing that your financial affairs are in capable hands. With professionals actively monitoring your portfolio, rebalancing as needed, and providing regular updates, you can have confidence in your financial future while focusing on other priorities in your life.

How Does Asset Management Service In Chattanooga Work? – The Functionality!

Access To A Wide Range Of Investments:

Asset management firms in Chattanooga offer access to a diverse array of investment opportunities, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), actual property funding trusts (REITs), and opportunity investments.

By leveraging their extensive network and expertise, these firms help clients build well-balanced portfolios aligned with their investment objectives and risk tolerance.

Read: Real Estate Fintechzoom – Revolutionized Investment!

Professional Bits of Advice And Guidelines On Asset Allocation:

Asset managers in Chattanooga offer professional advice and guidance on asset allocation, which involves determining the optimal mix of investments to achieve clients’ financial goals while managing risk.

They assess investment time horizon, liquidity needs, and risk tolerance to develop customised asset allocation strategies that align with clients’ objectives.

Detailed Portfolio Management Services:

Asset management firms provide detailed portfolio management services to actively monitor and adjust clients’ investment portfolios based on changing market conditions, economic trends, and individual goals. Portfolio managers conduct thorough analysis, implement investment strategies, and rebalance portfolios as needed to optimize performance and mitigate risk.

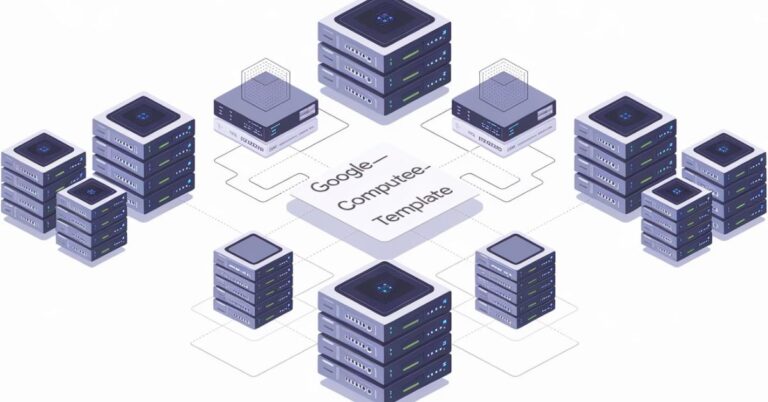

Risk Management Technologies:

Asset management services in Chattanooga utilize advanced risk management technologies and methodologies to identify, assess, and reduce investment risks.

These technologies help monitor portfolio volatility, analyze asset correlations, and implement risk mitigation strategies such as diversification and hedging to protect clients’ wealth against market downturns and unforeseen events.

Tax Planning Solutions:

Asset management firms offer tax planning solutions to help clients minimize tax liabilities and optimize after-tax investment returns. They employ tax-efficient investment strategies, such as tax-loss harvesting, asset location strategies, and retirement account optimization, to maximize tax benefits and preserve investment capital over the long term.

Reduced Stress From Financial Complexes:

By outsourcing investment management to asset management professionals in Chattanooga, clients experience reduced stress and anxiety associated with navigating complex financial markets and making investment decisions.

Asset managers provide peace of mind by handling all aspects of portfolio management, monitoring performance, and providing regular updates, allowing clients to focus on their personal and professional pursuits with confidence in their financial future.

Frequently Asked Questions:

Why should I consider asset management services in Chattanooga?

Asset management services in Chattanooga provide access to professional expertise, diversified investment opportunities, and personalized financial strategies to help individuals and businesses achieve their long-term financial objectives effectively.

What types of investments can I expect with asset management in Chattanooga?

Asset management services in Chattanooga provide access to a wide range of investments including stocks, bonds, mutual funds, ETFs, real estate, and alternative investments, allowing clients to build diversified portfolios tailored to their investment goals and risk tolerance.

How often will my portfolio be reviewed and adjusted?

The frequency of portfolio reviews and adjustments varies based on individual preferences and market conditions. Asset management firms typically conduct regular reviews, often quarterly or annually, to assess portfolio performance, rebalance assets, and make strategic adjustments as needed to align with clients’ objectives.

Are asset management services only for high-net-worth individuals?

No, asset management services in Chattanooga cater to individuals and businesses of varying financial backgrounds. Whether you’re a seasoned investor or just starting to build wealth, asset management firms offer tailored solutions to help you achieve your financial goals effectively.

Conclusion:

Asset management in Chattanooga, Tennessee entails supervising investments, portfolio optimization, and wealth preservation. It encompasses a range of financial strategies customized to clients’ objectives, provided by firms within Chattanooga’s economic landscape.

Read Also: