Bitcoin Price Fintechzoom – The King Of Cryptocurrency!

As I sat glued to my screen, watching the ever-fluctuating numbers dance before my eyes, one thing became abundantly clear: Bitcoin Price Fintechzoom isn’t just a phrase; it’s a journey of financial discovery. With each rise and fall, I immersed myself in cryptocurrency, navigating its highs and lows with excitement and caution.

Bitcoin Price Fintechzoom refers to the current value of Bitcoin displayed on the Fintechzoom platform, which constantly changes.

Now, read this article thoroughly to get over all the details on this keyword.

What Is Bitcoin? – Know In Detail!

Bitcoin, the pioneer of cryptocurrencies, is a decentralized digital currency created in 2009 by an unknown person or group using the pseudonym Satoshi Nakamoto.

It operates on a peer-to-peer network without intermediaries like banks or governments. Bitcoin transactions are recorded on a public ledger referred to as the blockchain, making sure transparency and security.

The deliver of Bitcoin is confined to 21 million coins, making it a deflationary asset. Users can buy, sell, and store Bitcoin in digital wallets protected by cryptographic keys.

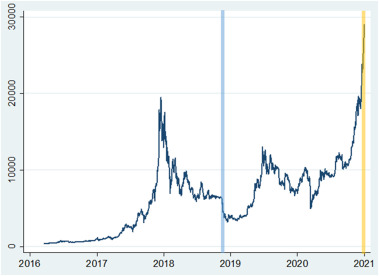

Bitcoin’s value is determined by supply and demand dynamics in the market, often experiencing significant price fluctuations.

Despite its volatile nature, Bitcoin has gained widespread acceptance as a store of value and a medium of exchange, with numerous merchants and businesses now accepting it as payment for goods and services. Bitcoin’s underlying technology, blockchain, is hailed for its potential to revolutionize various industries beyond finance, including supply chain management, healthcare, and voting systems.

As Bitcoin continues to evolve, its impact on the global economy and financial landscape remains profound, shaping the future of digital currencies and financial transactions.

Read Also: Fintechzoom Brent Crude – The Real-Time Tracker!

The Cryptocurrency Details For Brief Understanding – Here For You!

Cryptocurrency, a digital or virtual currency, relies on cryptographic techniques for secure financial transactions.

Apart from Bitcoin, thousands of cryptocurrencies exist, each with unique features and purposes. Ethereum, Ripple, Litecoin, and Cardano are prominent alternatives to Bitcoin.

Cryptocurrencies utilize decentralized networks based on blockchain technology to record and verify transactions.

This decentralized nature eliminates the need for a central authority, fostering transparency and reducing the risk of fraud. Cryptocurrency transactions are usually faster and more cost effective than traditional banking systems.

Investors and traders use cryptocurrency markets to capitalize on price fluctuations and speculative opportunities. However, the volatile nature of cryptocurrencies poses risks, and investors should exercise caution and conduct thorough research before investing.

Regulatory frameworks surrounding cryptocurrencies vary across jurisdictions, with some countries embracing them while others impose restrictions.

Despite regulatory challenges and security concerns, cryptocurrencies continue to gain traction as innovative financial instruments with the potential to reshape global finance.

As technology matures and adoption increases, cryptocurrencies are expected to play a significant role in the future of finance, offering greater financial inclusion and efficiency on a global scale.

Benefits Of Using Bitcoin – The Significance AnnouncedHere!

Decentralization and Financial Freedom:

Bitcoin operates on a decentralized network, free from control by any central authority like banks or governments. Users have complete control over their funds, enabling greater financial autonomy and freedom from traditional banking systems.

Lower Transaction Fees:

Compared to traditional financial institutions, Bitcoin transactions typically involve lower fees. Since no intermediaries are involved, users can send and receive funds globally at a fraction of the cost of traditional wire transfers or international payments.

Global Accessibility:

Bitcoin transcends geographical boundaries, allowing anyone with internet access to participate in the digital economy. This accessibility is especially beneficial for individuals in regions with limited access to banking services, providing them with a secure and inclusive means of financial participation.

Security and Transparency:

Bitcoin transactions are recorded on a public ledger called the blockchain, which is immutable and transparent.

This technology ensures the integrity of transactions and reduces the risk of fraud or tampering. Bitcoin’s cryptographic protocols also offer robust security measures, safeguarding users’ funds against unauthorized access or manipulation.

Hedge Against Inflation:

With its limited supply and deflationary nature, Bitcoin is a hedge against inflation and currency devaluation. Unlike fiat currencies, which can be subject to government manipulation and inflationary pressures, Bitcoin’s scarcity preserves its value over time, making it an attractive store of wealth for investors seeking protection against economic uncertainty.

Borderless Transactions:

Bitcoin enables seamless cross-border transactions without currency conversion or intermediary banks. This feature is particularly beneficial for international businesses and individuals conducting commerce or remittances across different countries, eliminating delays and reducing costs associated with traditional banking systems.

Innovative Potential:

Beyond its role as a digital currency, Bitcoin’s underlying blockchain technology holds immense potential for innovation across various industries, including finance, healthcare, supply chain management, and voting systems. As developers continue to explore its capabilities, Bitcoin could pave the way for groundbreaking solutions that enhance efficiency, transparency, and security in diverse sectors.

Comparison Of Bitcoin Price On Fintechzoom With Other Platforms – The Competitor Analysis!

Price Accuracy and Timeliness:

Evaluate how accurately Fintechzoom reflects the current price of Bitcoin compared to other leading platforms such as Coinbase, Binance, and Kraken. Analyze the timeliness of price updates and discrepancies between platforms to assess which platform provides the most reliable and up-to-date information.

User Interface and Experience:

Compare the user interface and experience of Fintechzoom with its competitors in terms of ease of navigation, charting tools, and customization options. Consider mobile responsiveness, intuitive design, and accessibility to determine which platform offers the most user-friendly experience for tracking Bitcoin prices.

Trading Features and Liquidity:

Explore the trading features and liquidity offered by Fintechzoom and its competitors, including order types, trading pairs, and volume metrics. Assess the liquidity and market depth on each platform to gauge the ease of executing trades and accessing liquidity during periods of high volatility.

Security and Reliability:

Examine the security measures and reliability of Fintechzoom and other platforms in safeguarding user funds and sensitive information. Evaluate factors such as two-factor authentication, cold storage solutions, and regulatory compliance to identify platforms that prioritize security and offer peace of mind to users.

Customer Support and Reputation:

Investigate the quality of customer support and the reputation of Fintechzoom and its competitors based on user reviews, community feedback, and historical performance.

Assess how effectively each platform addresses user inquiries, resolves issues, and maintains transparency to build trust and credibility among its user base.

Additional Features and Integration:

Consider any additional features and integrations offered by Fintechzoom and its competitors, such as news feeds, educational resources, and API support.

Determine which platform provides the most comprehensive suite of tools and resources to help users make informed decisions and stay knowledgeable about developments in the cryptocurrency market.

Read More: Silver Price Fintechzoom – Elevate Your Silver Investments!

How Can You Buy Bitcoin? – Investor’s Guide!

Step 1: Choose a Bitcoin Wallet:

Select a secure digital wallet to store your Bitcoin. Consider factors such as security features, ease of use, and compatibility with your device. Options include hardware wallets, software wallets, and mobile wallets.

Step 2: Select a Cryptocurrency Exchange:

Research and choose a reputable cryptocurrency exchange where you can buy Bitcoin. Compare trading fees, supported payment methods, regulatory compliance, and user reviews. Popular exchanges include Coinbase, Binance, Kraken, and Gemini.

Step 3: Complete the Verification Process:

Sign up for an account on your chosen exchange and complete the verification process, which may require providing personal information and identity verification documents. This step is necessary to comply with Know Your Customer (KYC) and anti-money laundering (AML) regulations.

Step 4: Deposit Funds:

Deposit fiat currency (e.g., USD, EUR, GBP) into your exchange account using supported payment methods such as bank transfers, credit/debit cards, or online payment processors. Ensure you follow the exchange’s deposit instructions and carefully verify the transaction details.

Step 5: Place an Order:

Navigate to the trading section of the exchange and place a buy order for Bitcoin. Specify the amount of Bitcoin you wish to purchase and review the order details, including the current market price and any applicable fees. Once you’re satisfied, confirm the order to execute the purchase.

Step 6: Withdraw Bitcoin to Your Wallet:

After purchasing Bitcoin, withdraw the funds from the exchange to your wallet for added security. Follow the withdrawal instructions provided by the exchange, ensuring that you input the correct wallet address and confirm the transaction details before finalizing the withdrawal.

Step 7: Secure Your Investment:

Implement security best practices to protect your Bitcoin investment. Enable two-factor authentication (2FA) on your exchange and wallet accounts, use strong and unique passwords, and consider additional security measures such as multi-signature authentication and hardware wallets for cold storage.

Step 8: Monitor Market Trends:

Stay informed about Bitcoin’s price movements and market trends using cryptocurrency news sources, market analysis tools, and price tracking websites. Monitor critical indicators and developments in cryptocurrency to make informed decisions about buying, selling, or holding Bitcoin.

Some Risks Associated With Investing In Bitcoin – You Must Avoid!

Investing in Bitcoin carries several risks that investors should know to make informed decisions and mitigate potential losses. One significant risk is the high volatility of Bitcoin prices, which can result in rapid and unpredictable fluctuations.

Various factors, including market speculation, regulatory developments, technological advancements, and macroeconomic trends, can influence the price of Bitcoin. As a result, investors may experience significant gains or losses in short periods, making Bitcoin investment inherently risky.

Another risk associated with investing in Bitcoin is security vulnerabilities and hacking threats. While Bitcoin transactions are secured by cryptographic protocols, digital wallets, and cryptocurrency exchanges remain vulnerable to cyberattacks and security breaches.

Hackers may exploit vulnerabilities in exchange platforms or target individual wallets to steal Bitcoin holdings, resulting in financial losses for investors.

Therefore, investors must implement robust security measures, such as using hardware wallets, enabling two-factor authentication, and choosing reputable exchanges with strong security protocols.

To minimize risks associated with Bitcoin investment, investors should conduct thorough research, diversify their investment portfolios, and exercise caution when entering the volatile cryptocurrency market.

By understanding the potential risks and implementing prudent risk management strategies, investors can navigate the complexities of Bitcoin investment more effectively and protect their capital from unforeseen losses,

The Bitcoin Mining – The Detailed Guide!

Bitcoin mining is the process of validating and recording transactions on the Bitcoin blockchain using computational power. Miners compete to solve complex mathematical puzzles and add new blocks to the blockchain, for which they are rewarded with newly minted bitcoins and transaction fees.

Bitcoin mining plays a crucial role in securing the network and maintaining the integrity of the decentralized ledger.

The mining process requires specialized hardware known as ASIC (Application-Specific Integrated Circuit) miners, designed to efficiently perform the complex calculations necessary for block validation.

Miners also need access to cheap electricity and high-speed internet connectivity to maximize profitability and compete effectively in the mining ecosystem.

However, the increasing difficulty of mining and the energy-intensive nature of Bitcoin mining has raised concerns about environmental sustainability and energy consumption.

Despite these challenges, Bitcoin mining remains a lucrative venture for miners who can overcome the initial investment costs and operational challenges.

As the Bitcoin network evolves, miners may adopt innovative technologies and sustainable practices to reduce environmental impact and increase efficiency in the mining process.

Bitcoin mining remains an integral part of the cryptocurrency ecosystem, driving innovation and securing the decentralized network against potential threats.

Tips For Utilizing Fintechzoom To Navigate Bitcoin Price Trends – Know All Here!

Stay Informed:

Regularly monitor Fintechzoom’s real-time price charts, market analysis, and news updates to stay informed about the latest developments and trends in the Bitcoin market. Fintechzoom offers comprehensive coverage of cryptocurrency markets, enabling investors to make data-driven decisions based on accurate and up-to-date information.

Utilize Technical Analysis:

Use Fintechzoom’s charting tools and technical analysis indicators to analyze Bitcoin price movements and identify potential trading opportunities. Specialized analysis techniques such as trend analysis, support, resistance levels, and momentum indicators can help investors gauge market sentiment and predict future price movements.

Set Price Alerts:

Take advantage of Fintechzoom’s price alert feature to receive notifications when Bitcoin reaches specific price levels or experiences significant price fluctuations.

Price alerts can help investors capitalize on favorable trading opportunities or mitigate risks by setting stop-loss orders to protect against adverse price movements.

Diversify Your Portfolio:

Consider diversifying your investment portfolio beyond Bitcoin to mitigate risk and capitalize on opportunities in other cryptocurrency markets. Fintechzoom offers access to a wide range of digital assets, allowing investors to explore alternative investment options and diversify their exposure to cryptocurrencies.

Frequently Asked Questions:

Is Bitcoin safe to use?

While Bitcoin transactions are secure, strong passwords and security measures are essential to keep your digital wallet safe from hackers and scams.

What can I do with Bitcoin?

You can use Bitcoin to buy products and services from merchants who accept it, invest in it for potential profit, or send it to friends and family as digital money.

Can I buy a fraction of a Bitcoin?

Yes, you can buy a fraction of a Bitcoin. Bitcoin is divisible, and you can buy as little as one hundred millionth of a Bitcoin called a Satoshi.

Is Bitcoin legal?

The legality of Bitcoin varies by country. Bitcoin is legal to buy, sell, and use in many places, but it’s essential to check your local regulations.

Conclusion:

Bitcoin Price Fintechzoom is the fluctuating value of Bitcoin shown on the Fintechzoom platform, which changes continuously.

Read Also:

. Online Loans Fintechzoom – Know Everything Here!

. Msft Stock Fintechzoom – The Secure Investment Guide!

. Netflix Stock Fintechzoom – A Comprehensive Guide On Investment!