Fintechzoom Best Forex Broker – The Detailed Guide For You!

Embarking on your journey in the vast realm of forex trading, you’re undoubtedly seeking the guidance of a reliable compass to navigate the markets. Enter Fintechzoom’s quest for the best forex broker, where expertise meets opportunity and precision aligns with profitability.

Fintechzoom’s best forex broker signifies the top-rated brokerage firm recommended by Fintechzoom. It reflects excellence in trading services, platforms, regulations, fees, and customer satisfaction, aiding traders in making informed decisions for their forex endeavours.

Join us as we unveil the top contenders, explore their offerings, and uncover the gateway to your trading success.

What Is The Forex Broker? – A Brief Overview!

**What Is The Forex Broker? – A Brief Overview!**

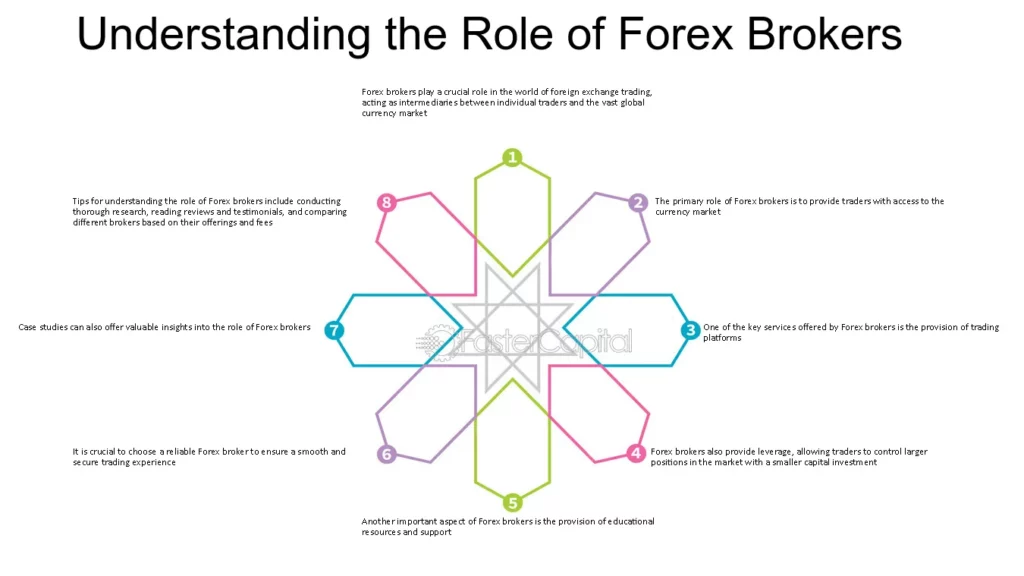

A forex broker intermediates traders and the foreign exchange market. They facilitate currency trading by providing access to trading platforms, market analysis tools, and execution services. Forex brokers enable individuals and institutions to participate in the global currency exchange market.

Traders rely on forex brokers to execute buy and sell orders for various currency pairs. These brokers offer trading platforms where traders can analyse market trends, place orders, and manage their positions. Additionally, forex brokers often provide leverage, allowing traders to control more significant positions with less capital.

Choosing the right forex broker is crucial for traders’ success. Factors such as regulation, spreads, commissions, execution speed, and customer support play a significant role in determining the reliability and suitability of a forex broker.

Traders should conduct thorough research and consider their trading preferences and risk tolerance before selecting a forex broker.

In summary, forex brokers are vital in facilitating currency trading in the global forex market. They provide the necessary tools, technology, and support for traders to buy and sell currencies. Understanding the role of forex brokers is essential for traders looking to enter the market and navigate its complexities effectively.

Read: Fintechzoom Cost Of Living – Probe Savings!

Significance Of Forex Brokers – Importance Decoded!

Facilitating Currency Trading:

Forex brokers act as intermediaries, connecting traders with the global forex market. Through their trading platforms, brokers offer access to a wide range of currency pairs, allowing traders to capitalize on exchange rate fluctuations and engage in buying and selling currencies.

Additionally, brokers provide leverage, enabling traders to control larger positions with a fraction of the capital, thereby amplifying their trading opportunities.

Mitigating The Risk Management:

Effective risk management is essential in forex trading, and forex brokers play a crucial role in helping traders mitigate risks. Brokers offer risk management tools such as stop-loss orders, limit orders, and margin requirements to help traders protect their capital and manage their exposure to market volatility. Moreover, regulated forex brokers adhere to strict guidelines and standards, providing traders with a level of security and assurance in their trading activities.

Some Essential Features Of Forex Brokers – Explained For Users!

Security:

Forex brokers prioritize the security of traders’ funds and personal information. They implement robust security measures, such as encryption protocols and secure payment gateways, to safeguard against unauthorized access and cyber threats.

Regulation:

Regulation ensures that forex brokers adhere to stringent standards and guidelines set by regulatory authorities. Regulated brokers offer traders a level of transparency and accountability, providing assurance that their funds are held in segregated accounts and that trading practices are fair and ethical.

Trading platforms:

Trading platforms serve as the interface between traders and the forex market. Forex brokers offer a variety of trading platforms, each equipped with features such as charting tools, technical indicators, and order execution capabilities, to cater to the diverse needs and preferences of traders.

Trading tools:

Forex brokers provide traders with a range of trading tools designed to enhance their trading experience and decision-making process. These tools may include economic calendars, market Analysis, trading signals, and risk management features, empowering traders to make informed and strategic trading decisions.

Pinnace of security and innovation:

Leading forex brokers prioritize both security and innovation, continuously investing in cutting-edge technology and infrastructure to provide traders with a secure and innovative trading environment.

By leveraging advanced security measures and embracing technological advancements, brokers ensure that traders can trade with confidence and efficiency.

Unparalleled customer support:

Exceptional customer support is a hallmark of reputable forex brokers. Brokers offer dedicated support channels, including live chat, email, and phone support, staffed by knowledgeable and responsive representatives who assist traders with inquiries, technical issues, and account-related matters.

Transparent and low-cost trading:

Transparency and competitive pricing are key features offered by forex brokers. Transparent pricing structures, with clear details on spreads, commissions, and fees, enable traders to assess trading costs accurately. Additionally, brokers strive to offer low-cost trading solutions, allowing traders to maximize their returns while minimizing expenses.

Best Forex Brokers On Fintechzoom For Beginners – Take Start Now!

eToro:

eToro stands out for its social trading features, allowing beginners to copy the trades of experienced investors. The platform offers a range of educational materials and a demo account for practice.

IG:

IG provides a user-friendly platform with access to a wide range of markets, including forex. Beginners benefit from IG’s extensive educational resources, including webinars, tutorials, and market analysis tools.

Forex.com:

Forex.com offers a user-friendly trading platform tailored to beginners, along with a wealth of educational resources and research tools. The platform provides access to a variety of currency pairs and trading options.

Capital.com:

Capital.com offers an intuitive trading platform with educational resources and analytical tools for beginners. The platform emphasises risk management and provides access to various markets, including forex.

Plus 500:

Plus500 provides a straightforward trading platform suitable for beginners, offering a demo account for practice and educational resources to help users learn the basics of forex trading.

Read:Fintechzoom Retirement Calculator – Secure Future!

Best Forex Brokers On Fintechzoom For Experts – Explore Here!

IC Markets:

It is renowned for its low spreads, fast execution speeds, and advanced trading platforms. With access to a wide range of currency pairs and CFDs, IC Markets is favoured by experienced traders for its institutional-grade trading environment.

Pepperstone:

Pepperstone offers competitive pricing, advanced trading tools, and a robust trading infrastructure tailored to experienced traders. The broker provides access to multiple liquidity providers, allowing for tight spreads and rapid order execution.

XM:

XM provides a range of sophisticated trading platforms, advanced charting tools, and comprehensive market analysis resources suitable for experienced traders. With competitive pricing and a wide selection of tradable instruments, XM is a popular choice among seasoned traders.

Saxo Bank:

Saxo Bank offers a comprehensive suite of trading tools and investment products, including forex, CFDs, stocks, and options. With access to global markets and advanced trading platforms, Saxo Bank caters to the diverse needs of experienced traders and institutional clients.

Interactive Brokers:

Interactive Brokers is renowned for its advanced trading platforms, extensive range of tradable assets, and direct market access. With competitive pricing and a wide range of order types, Interactive Brokers is a top choice for experienced traders seeking professional-grade trading solutions.

Frequently Asked Questions:

Are demo accounts offered by forex brokers beneficial?

Yes, demo accounts allow you to practice trading in a risk-free environment using virtual funds. They help beginners learn about trading platforms and develop strategies before risking real money.

How can I assess the reliability of a forex broker?

Look for brokers regulated by reputable authorities, transparent pricing and policies, positive reviews from clients, and a track record of reliability and security in the industry.

Do forex brokers charge commissions?

Some brokers charge commissions on trades, while others make money through spreads. It’s essential to understand a broker’s fee structure and how it may impact your trading costs.

Can I trade forex with a small amount of capital?

Yes, many forex brokers offer the opportunity to trade with a small amount of capital through leverage. However, it’s crucial to understand the risks involved and use leverage responsibly.

Conclusion:

Fintechzoom’s best forex broker is the highest-rated brokerage firm suggested by Fintechzoom. It excels in trading services, platforms, regulations, fees, and customer satisfaction, helping traders make informed decisions for their forex activities.

Read Also: