Fintechzoom Car Insurance – Avail Today!

You’re cruising down the road, wind in your hair, tunes blasting, when suddenly, life throws you a curveball – a fender bender! Been there, done that. That’s why diving into the world of Fintechzoom Car Insurance was a game-changer for me.

Fintechzoom Car Insurance provides complete coverage for your driving needs at competitive rates, ensuring peace of mind.

Let me share my journey of finding reliable coverage that’s got my back through thick and thin.

Excellent Benefits Of Fintechzoom Car Insurance – Know Must!

Comprehensive Coverage:

Fintechzoom Car Insurance offers comprehensive coverage for various scenarios, including accidents, theft, vandalism, and natural disasters. With a wide range of coverage options, you can rest assured that your vehicle and finances are protected.

Affordable Premiums:

One of the standout benefits of Fintechzoom Car Insurance is its affordable premiums. By offering competitive rates without compromising coverage quality, Fintechzoom ensures you get the best value for your money.

24/7 Customer Support:

Fintechzoom prioritises customer satisfaction by providing round-the-clock support. Whether you have questions about your policy, need to file a claim, or require assistance in emergencies, their dedicated support team is always there to help.

Flexible Policy Options:

With Fintechzoom Car Insurance, you can tailor your policy to suit your individual needs. From choosing your coverage limits to adding optional extras such as roadside assistance and rental car reimbursement, Fintechzoom offers flexibility to accommodate your lifestyle.

Read: Fintechzoom Life Insurance – Secure Your Life!

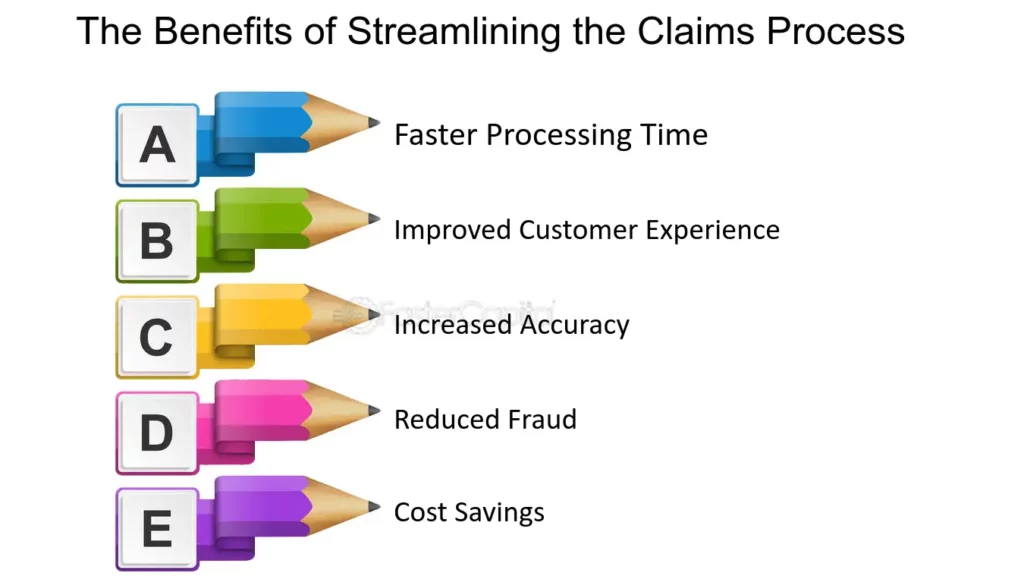

Fast and Hassle-Free Claims Process:

Dealing with insurance claims can be stressful, but Fintechzoom makes it hassle-free. Their streamlined claims process ensures prompt resolution, allowing you to return to the road immediately after an incident.

Additional Benefits and Discounts:

Fintechzoom Car Insurance goes the extra mile by offering additional benefits and discounts to policyholders. Whether it’s safe driving discounts, multi-policy discounts, or rewards for loyalty, Fintechzoom rewards responsible drivers and helps you save even more on your premiums.

Online Account Management:

Managing your car insurance policy has always been challenging with Fintechzoom’s convenient online portal. From accessing policy documents to making payments and updating your information, you have complete control over your policy anytime, anywhere.

Peace of Mind:

Ultimately, the most significant benefit of Fintechzoom Car Insurance is the peace of mind it provides. Knowing that you’re adequately protected against unforeseen events allows you to drive confidently and focus on enjoying the journey ahead.

Why To Choose The Fintechzoom Car Insurance? – The Need Defined Here!

Choosing Fintechzoom Car Insurance is based on practicality and peace of mind. With many insurance providers available, a reliable and trustworthy insurer becomes paramount.

Fintechzoom stands out in the competitive landscape by offering comprehensive coverage and exceptional customer service.

Firstly, Fintechzoom Car Insurance provides various coverage options for diverse needs and preferences. Whether you’re seeking protection against accidents, theft, vandalism, or natural disasters, Fintechzoom has you covered.

Their policies are designed to safeguard your vehicle and financial well-being, ensuring that you’re prepared for the unexpected on the road.

Moreover, affordability is a critical factor that sets Fintechzoom apart. In an era where rising insurance premiums can strain budgets, Fintechzoom strives to offer competitive rates without compromising coverage quality.

By keeping premiums affordable, Fintechzoom makes it easier for drivers to access the protection they need without breaking the bank. This commitment to affordability extends to their range of discounts and rewards, further incentivising responsible driving behaviour and loyalty among policyholders.

Another compelling reason to choose Fintechzoom Car Insurance is its unwavering dedication to customer satisfaction. From its 24/7 customer support to its fast and hassle-free claims process, Fintechzoom prioritises the needs of its policyholders at every turn.

Whether you have questions about your policy, need assistance during an emergency, or want to explore additional coverage options, Fintechzoom’s knowledgeable and responsive team guides you every step of the way.

In essence, the decision to choose Fintechzoom Car Insurance boils down to a combination of comprehensive coverage, affordability, and exceptional customer service.

With Fintechzoom, drivers can enjoy knowing they’re protected by a reliable and reputable insurer, allowing them to focus on the road ahead confidently.

Read: Personal Loans Fintechzoom – Explore In Depth!

The Insurance Coverage By Fintechzoom Car Insurance – The Given Facilities!

Regarding insurance coverage, Fintechzoom Car Insurance stands out for its comprehensive array of facilities tailored to meet the diverse needs of drivers.

From basic liability coverage to extensive protection against unforeseen events, Fintechzoom offers a range of options to ensure drivers have the peace of mind they deserve on the road.

Firstly, Fintechzoom provides liability coverage, a legal requirement in most states. This coverage helps pay for the medical expenses and property damage of other drivers and passengers if you’re found at fault in an accident.

Additionally, Fintechzoom offers collision coverage, which helps repair or replace your vehicle if it’s damaged in a collision with another vehicle or object. This coverage is precious for drivers who want financial protection in case of accidents.

Moreover, Fintechzoom Car Insurance extends beyond basic coverage to include comprehensive insurance, which protects your vehicle from non-collision incidents such as theft, vandalism, and natural disasters.

This means that whether your car is damaged in a storm, stolen from a parking lot, or vandalised while parked on the street, Fintechzoom has you covered. With comprehensive insurance, drivers can enjoy added peace of mind knowing their vehicles are protected against various potential risks.

In addition to these core coverages, Fintechzoom offers optional extras such as roadside assistance, rental car reimbursement, and uninsured/underinsured motorist coverage to provide drivers with even more excellent protection and convenience.

Fintechzoom ensures drivers can customise their policies to suit their needs and preferences by offering a comprehensive suite of insurance facilities.

The Process To Get Started With Fintechzoom Car Insurance – Complete Guide!

Research and Compare Plans:

Research Fintechzoom’s car insurance plans online or contact their customer service representatives. Compare coverage options, premiums, and available discounts to determine which plan best suits your needs and budget.

Gather Necessary Information:

Before initiating the application process, gather essential information such as your driver’s license number, vehicle registration details, and any existing insurance policies you may have. Having this information readily available will streamline the application process.

Request a Quote:

Once you’ve identified the insurance plan that aligns with your requirements, request a quote from Fintechzoom. You can obtain a quote online through their website or by contacting a Fintechzoom representative directly. Provide accurate information to receive an accurate quote tailored to your specific circumstances.

Review Policy Terms and Conditions:

Carefully review the terms and conditions of the insurance policy provided by Fintechzoom. Pay attention to coverage limits, deductibles, exclusions, and any optional add-ons or endorsements. Ensure that you fully understand the details of the policy before proceeding.

Initiate the Application Process:

Once you’re satisfied with the terms and conditions outlined in the policy, initiate the application process with Fintechzoom. This may involve completing an online application form, providing necessary documentation, and agreeing to the terms of the policy.

Undergo Underwriting Process:

After submitting your application, Fintechzoom will typically conduct an underwriting process to assess your risk profile and determine the final premium for your policy. This process may involve reviewing your driving record, claims history, and other relevant factors.

Review and Sign the Policy:

Upon approval of your application, carefully review the finalised policy documents provided by Fintechzoom. Ensure that all details are accurate and reflect the coverage options you selected. Once satisfied, sign the policy documents to activate your Fintechzoom Car Insurance coverage.

Make Payment:

Finally, make the initial premium payment as outlined in the policy terms. You may pay online, over the phone, or through other convenient payment methods accepted by Fintechzoom.

Frequently Asked Questions:

How can I save money on my Fintechzoom Car Insurance?

You can save money with Fintechzoom by being a safe driver, bundling policies, and taking advantage of discounts they offer.

How do I file a claim with Fintechzoom Car Insurance?

If something happens, you can file a claim by calling Fintechzoom’s claims department or using their online portal. They’ll guide you through the process.

Can I customise my Fintechzoom Car Insurance policy?

Yes, you can! Fintechzoom offers options like adding roadside assistance or increasing coverage limits to fit your needs better.

Do I need car insurance if I don’t drive often?

Yes, it’s still essential to have car insurance even if you don’t drive a lot. It protects you and others on the road if something unexpected happens.

What happens if I let my Fintechzoom Car Insurance policy lapse?

If your policy lapses, you could face fines or legal consequences. It’s essential to keep your coverage active to stay protected while driving.

Conclusion:

Fintechzoom Car Insurance offers comprehensive protection for all your driving requirements at competitive prices, guaranteeing peace of mind while on the road.

Read Also: