Fintechzoom Mortgage Calculator – Explore In Depth!

Having navigated the complexities myself, the Fintechzoom Simple Mortgage Calculator became my compass, simplifying the intricate path of mortgage calculations.

Fintechzoom’s Mortgage Calculator simplifies home finance. Enter loan details, click calculate, and get instant insights for informed decisions.

Let me share how this tool, born out of my homeownership quest, can be your guiding light in the realm of mortgages, making the dream of having your own home an achievable reality.

The Excellent Home Approach – Dive In!

Commerce on the exceptional journey towards homeownership with the “Excellent Home Approach,” a comprehensive guide to making your dream home a reality. Dive into a user-friendly process to demystify the complexities of acquiring a home.

This approach ensures that every step is accessible, empowering you to navigate the intricate world of real estate confidently. The first step in the “Excellent Home Approach” is to utilize the Fintechzoom Simple Mortgage Calculator, a tool crafted to simplify the financial aspects of homeownership.

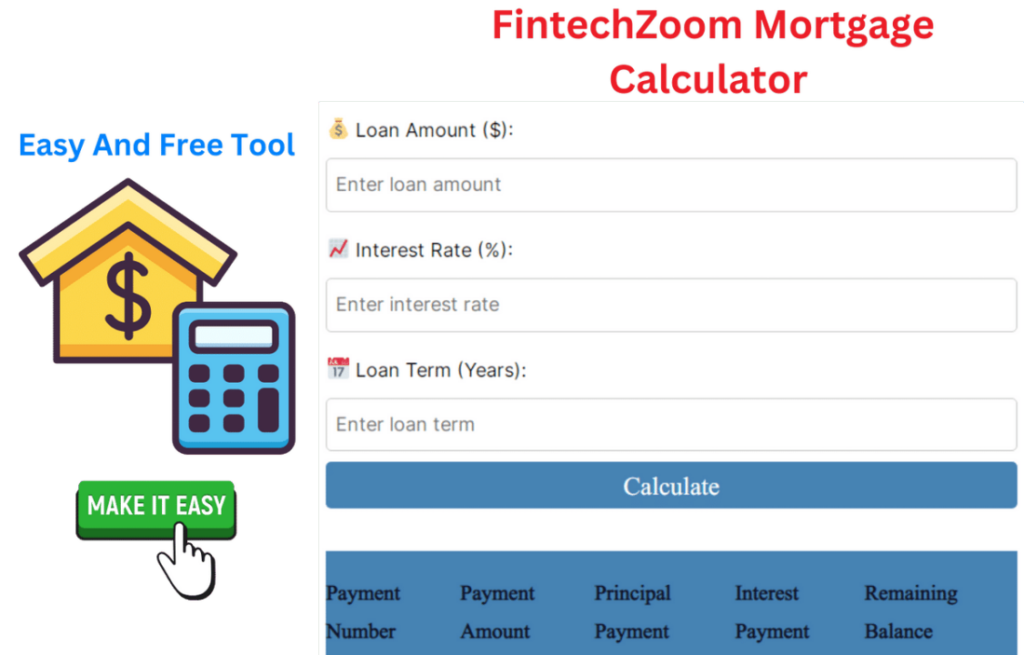

This calculator, marked by its intuitive interface, lets you input crucial information like loan amount, interest rate, and loan term with just a few clicks. Instantly, it provides a clear breakdown of your monthly payments, total interest paid, and an easy-to-understand amortization schedule.

Moving beyond mere calculations, the “Excellent Home Approach” offers a holistic view of affordability. It delves into the nuances of your potential mortgage, allowing you to assess your financial readiness and make well-informed decisions.

By transparently displaying the division of principal and interest in each payment, the approach enables you to comprehend how much goes towards owning your home and how much contributes to paying off the loan or other short term personal loan.

This powerful approach is not limited to first-time homebuyers; it extends its benefits to existing homeowners. Whether you’re exploring refinancing options, comparing lenders for the best deal, or engaging in long-term financial planning, the “Excellent Home Approach” with the Fintechzoom Simple Mortgage Calculator is a valuable companion at every stage of your homeownership journey.

With accuracy, transparency, customization, and accessibility, this approach empowers you to make informed decisions, building confidence and reducing the stress associated with the mortgage process. Embark on the “Excellent Home Approach” today and pave the way to achieving your homeownership goals.

Fintechzoom Mortgage Calculator As A Powerful Tool Regarding Homeownership – Explore!

Delve into homeownership with the Fintechzoom Mortgage Calculator, a powerful tool that revolutionizes how you approach owning a home. This innovative calculator serves as a guiding force, offering a comprehensive exploration of vital financial aspects tied to homeownership.

Navigating the intricate landscape of mortgages becomes a seamless journey with the Fintechzoom Mortgage Calculator. Its user-friendly interface invites users, whether seasoned homeowners or first-time buyers, to effortlessly input essential details such as loan amount, interest rate, and loan term.

The magic happens with a click, as the calculator swiftly unveils a detailed breakdown of monthly payments, total interest accrued, and a clear amortization schedule. This transparency empowers individuals to make informed decisions regarding their financial future.

Beyond its role in simplifying calculations, the Fintechzoom Mortgage Calculator stands out for its ability to provide a holistic perspective on homeownership affordability. By illuminating the interplay between principal and interest in each payment, this tool enables users to grasp the financial dynamics of their mortgage journey.

Whether you are contemplating your first home purchase or looking to optimize your existing mortgage, the Fintechzoom Mortgage Calculator is a versatile companion. Its accuracy, transparency, customization options, and accessibility make it a powerful resource at every stage of your homeownership exploration.

Embrace the journey of homeownership with confidence, armed with the insights and clarity provided by the Fintechzoom Mortgage Calculator.

Dicision Making Ability of the Mortage Calculator – Elevate Now!

Come into the world of empowered decision-making with the Fintechzoom Mortgage Calculator, a tool that goes beyond mere calculations, elevating your ability to navigate the complexities of mortgage choices.

1. Seamless Exploration:

The Fintechzoom Mortgage Calculator serves as a compass, simplifying the intricate path of mortgage calculations and empowering users to make informed decisions. Its user-friendly interface and intuitive design create a seamless exploration experience.

With just a few clicks, users can input crucial information such as loan amount, interest rate, and loan term, instantly receiving a comprehensive view of their monthly payments, total interest paid, and a clear amortization schedule.

This seamless exploration ensures that users can easily grasp the financial implications of their mortgage, paving the way for confident decision-making.

2. Holistic Affordability Insights:

This dynamic tool extends its prowess beyond numerical calculations, providing valuable insights into the affordability of a potential mortgage. By transparently displaying the breakdown of foremost and interest in each payment, the Fintechzoom Mortgage Calculator allows users to understand not only the financial aspects but also the real cost of owning a home.

This holistic view enhances decision-making by enabling users to assess their financial readiness and make choices aligned with their homeownership goals. Elevating your decision-making ability, this calculator becomes an indispensable resource for individuals at any stage of their homeownership journey.

3. From First-Time Buyers to Seasoned Homeowners:

The Fintechzoom Mortgage Calculator is not confined to first-time homebuyers; it extends its utility to seasoned homeowners. Beyond exploring initial home purchases, existing homeowners can leverage this tool to investigate refinancing options, understand potential savings from lower interest rates, and compare different lenders for the best deals.

It becomes an invaluable companion for financial planning, aiding individuals in budgeting for future homeownership goals and assessing their financial readiness.

Thus, from the first step into homeownership to strategic financial planning, this calculator becomes a universal tool, elevating decision-making capabilities for everyone.

Types Of Mortage Calculator – Explore the Variety!

1. Fixed-Rate Mortgage Calculator:

Begin your exploration with the Fixed-Rate Mortgage Calculator, a stalwart in the world of mortgage financing. This calculator specializes in providing insights into mortgages with a constant interest rate throughout the loan term.

Users can input their loan amount, interest rate, and loan term to obtain accurate estimations of monthly payments, enabling them to plan and budget with stability. This calculator becomes a valuable companion for those seeking a predictable and steady financial path in their homeownership journey.

2. Adjustable-Rate Mortgage (ARM) Calculator:

Dive into the dynamic realm of the Adjustable-Rate Mortgage (ARM) Calculator, tailored for those who embrace financial adaptability. As interest rates fluctuate, this calculator empowers users to explore the potential variations in their monthly payments based on market changes.

By inputting initial interest rates, adjustment periods, and other essential details, users gain insights into the flexibility and potential savings associated with ARM mortgages. This tool becomes a strategic ally for individuals who value the adaptability of their mortgage terms in response to market dynamics.

3. Government-Insured Mortgage Calculator:

Navigate the terrain of government-insured mortgages with a specialized calculator designed to unravel the financial intricacies of these unique loan types. Whether it’s FHA, VA, or USDA loans, this calculator aids users in understanding the nuances of government-backed mortgages.

By inputting relevant details such as loan amount and interest rates, users can assess the monthly payment structure and gain clarity on the added assurance provided by these specialized mortgage programs.

This calculator becomes an indispensable resource for those exploring the security and benefits associated with government-backed homeownership.

Guide To Use Fintechzoom Mortgage Calculator – A Complete Process You Should Know!

Step 1: Navigate to Fintechzoom’s Mortgage Calculator Section:

Begin your journey by accessing the Fintechzoom website and navigating to the dedicated Mortgage Calculator section. This intuitive step lays the groundwork for your exploration into the financial dynamics of homeownership.

Step 2: Enter Your Loan Details

With the calculator at your fingertips, input the essential details of your potential mortgage. Start by entering the loan amount you wish to borrow. This represents the total sum required to finance your home purchase and serves as the foundation for the subsequent calculations.

Step 3: Specify Your Interest Rate

Move forward by specifying the interest rate you expect from your lender. Consider current market rates and any special terms or promotions that might influence this crucial factor. The interest rate significantly impacts the overall affordability of your mortgage, making this step a pivotal one in the calculation process.

Step 4: Determine Your Loan Term:

Choose the duration of your loan, typically measured in years. Common terms include 15, 20, or 30 years. This decision influences both your monthly payments and the overall interest paid over the life of the loan. Align the loan term with your financial goals and preferences to ensure a tailored approach to your homeownership journey.

Safety While Using Fintechzoom Mortgage Calculator – Stay Secure, Stay Safe!

Joining you on your homeownership journey with the Fintechzoom Mortgage Calculator involves not just financial planning but also ensuring a secure and safe online experience.

Let us delve into the details of how Fintechzoom prioritizes your safety while utilizing their mortgage calculator, fostering an environment where you can stay secure every step of the way.

First and foremost, Fintechzoom understands the paramount importance of Privacy. When using the Mortgage Calculator, you can rest assured that your personal information remains confidential.

The calculator requires no registration or the input of sensitive personal details. This commitment to privacy builds a foundation of trust, allowing users to engage with the tool without concerns about the misuse or unauthorized access to their information.

Fintechzoom prioritizes your security, ensuring that your journey towards homeownership is not only financially sound but also safeguarded against potential privacy risks.

In addition to privacy, Fintechzoom places a strong emphasis on the Security of its online tools, The Mortgage Calculator is designed within a secure online environment, employing encryption protocols to protect data transmission.

This encryption ensures that your inputs and results are shielded from potential threats, adding an extra layer of security to your financial planning endeavors. By prioritizing the security of user data, Fintechzoom ensures that individuals can engage with the Mortgage Calculator confidently, knowing that their sensitive information is handled with the utmost care and protection.

Frequently Asked Questions:

1. Is Fintechzoom Mortgage Calculator only for first-time homebuyers?

Not at all! It’s for everyone. Whether you’re buying your first home or refinancing, the calculator guides you through various scenarios and options.

2. Can I access Fintechzoom Mortgage Calculator on my mobile phone?

Yes, you can! It’s available online and works on mobile devices, so you can use it anytime and anywhere for convenient financial planning.

3. How does Fintechzoom ensure the security of my data while using the calculator?

Your data is secure. Fintechzoom prioritizes privacy, requiring no personal information, and the calculator operates in a secure online environment with encryption to protect your inputs.

4. Do I need to register or provide personal information to use the calculator?

No, you don’t. It’s completely free to use, and no registration or personal details are required for the calculations.

Conclusion:

Simplify your home finance with Fintechzoom’s Mortgage Calculator. Just input your loan details, click calculate, and instantly gain insights for making informed decisions.

I hope this guide will help you in essence.

Read More: