Fintechzoom Msft Stock – The Best Cryptocurrency Guide For You!

Today, we will delve into the heart of innovation, exploring the intricacies of MSFT stock – a symbol of resilience and transformation in finance.

Fintechzoom MSFT Stock denotes shares of Microsoft Corporation traded on stock exchanges. It represents ownership in Microsoft, renowned for its software, cloud services, and hardware.

Join us as we uncover the stories, strategies, and secrets behind Microsoft’s stock performance, navigating the winds of change together.

The Historical Overview Of Msft Stock – Introductory Explanation!

Delving into the historical overview of MSFT stock unveils a captivating growth, resilience, and innovation narrative. Microsoft, founded by Bill Gates and Paul Allen in 1975, emerged as a global technology giant, reshaping the landscape of computing and software development.

Since its initial public offering (IPO) in 1986, MSFT stock has witnessed remarkable transformations, reflecting Microsoft’s evolution from a software company to a diversified technology powerhouse. Throughout its history, MSFT stock weathered market fluctuations, technological disruptions, and competitive pressures, demonstrating resilience and adaptability in dynamic market environments.

As Microsoft expanded its product portfolio to include operating systems, productivity software, cloud services, and hardware devices, MSFT stock emerged as a cornerstone of many investment portfolios.

The historical overview of MSFT stock encompasses milestones such as the launch of Windows operating systems, the expansion into enterprise solutions with Microsoft Office, and the strategic shift towards cloud computing with Azure.

Understanding the historical trajectory of MSFT stock provides valuable insights into Microsoft’s strategic vision, market dynamics, and competitive positioning.

As investors analyze historical data, quarterly earnings reports, and market trends, they gain a deeper appreciation for the factors driving MSFT stock performance and its enduring relevance in the ever-changing world of technology and finance.

Read: Dogecoin Price Fintechzoom – The Detailed Guidebook For You!

Some Factors That Affect Fintechzoom Msft Stock – Know In Detail!

Economic Factors:

Economic conditions play a significant role in shaping MSFT stock performance. Factors such as GDP growth, inflation rates, interest rates, and unemployment levels impact consumer spending, corporate investment, and overall business sentiment, consequently influencing Microsoft’s revenue streams and market valuation.

Technological Advancements:

Technological advancements drive innovation and shape the competitive landscape in the technology sector, directly impacting MSFT stock.

Microsoft’s ability to innovate and adapt to emerging technologies such as artificial intelligence, cloud computing, and augmented reality influences its product offerings, market positioning, and long-term growth prospects, thus affecting investor confidence and stock performance.

Market Competition:

Market competition poses both challenges and opportunities for Fintechzoom MSFT stock. Rivalry from other technology companies, including Apple, Google, and Amazon, as well as smaller startups and niche players, can exert pressure on Microsoft’s market share, pricing strategies, and product differentiation efforts.

Monitoring competitive dynamics and Microsoft’s ability to maintain its competitive edge is crucial for investors assessing MSFT stock performance in a dynamic and competitive market environment.

Recent Trends Of Msft Stock Fintechzoom – Must Know!

In recent times, Fintechzoom has closely monitored the trends surrounding MSFT stock, providing valuable insights for investors navigating the dynamic landscape of technology investments.

Microsoft’s stock performance has been characterized by several noteworthy trends, reflecting shifts in market sentiment, technological innovations, and macroeconomic factors.

One prominent trend observed in the recent trajectory of MSFT stock is its resilience amid market volatility and uncertainty. Despite periodic fluctuations in broader market indices and geopolitical tensions, Microsoft’s stock has demonstrated stability and resilience, often outperforming market benchmarks.

This resilience can be attributed to Microsoft’s diverse revenue streams, strong balance sheet, and strategic investments in cloud computing, artificial intelligence, and enterprise solutions.

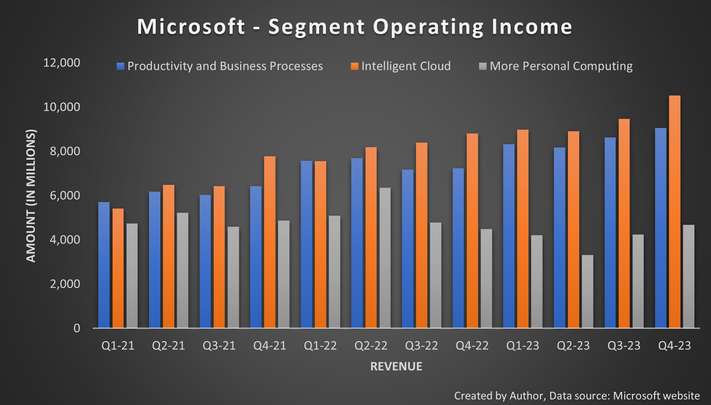

Another notable trend shaping MSFT stock performance is the increasing significance of cloud computing and digital transformation initiatives.

Microsoft’s Azure cloud platform has emerged as a key driver of revenue growth and profitability, capturing market share from competitors and expanding its ecosystem of enterprise clients.

As businesses accelerate their digital transformation efforts and embrace cloud-based solutions, Microsoft stands to benefit, driving sustained growth in MSFT stock.

Furthermore, investor sentiment towards Microsoft’s strategic acquisitions, product innovations, and leadership transitions has influenced the recent trends in MSFT stock.

From the acquisition of LinkedIn to the launch of new Surface devices and advancements in productivity software, Microsoft’s ability to innovate and execute on its strategic vision has resonated positively with investors, contributing to the upward trajectory of MSFT stock.

In conclusion, understanding the recent trends of MSFT stock on Fintechzoom provides investors with valuable insights into Microsoft’s resilience, innovation, and strategic positioning in the ever-evolving technology landscape.

By staying informed about these trends and their underlying drivers, investors can make informed decisions and capitalize on opportunities in the dynamic world of tech investments.

Read: Fintechzoom Nvda Stock – The Detailed Guide!

Key Benefits Of Investing In Fintechzoom Msft Stock – Compiled Here!

Steady Growth Potential:

MSFT stock offers investors the potential for steady, long-term growth, driven by Microsoft’s diversified revenue streams, innovative product portfolio, and leadership in the technology sector.

Dividend Income:

Microsoft pays regular dividends to its shareholders, making MSFT stock an attractive option for income investors seeking dividend payments alongside potential capital appreciation.

Market Leadership:

Microsoft’s dominant market position across various segments, including cloud computing, productivity software, and enterprise solutions, enhances the stability and growth prospects of MSFT stock.

Innovation and Adaptability:

Microsoft’s commitment to innovation and adaptability enables it to stay ahead of industry trends and emerging technologies, fostering investor confidence in the long-term prospects of MSFT stock.

Some Risks Are Also Associated With Investment In Msft Stock – Don’t Neglect!

Market Volatility:

Like any stock, MSFT stock is susceptible to market volatility, influenced by macroeconomic factors, geopolitical tensions, and industry dynamics, which may lead to fluctuations in its price.

Competition and Disruption:

Intense competition in the technology sector and potential disruptions from new entrants or technological innovations pose risks to Microsoft’s market share and revenue growth, impacting the performance of MSFT stock.

Regulatory and Legal Risks:

Regulatory changes, legal disputes, and antitrust investigations may affect Microsoft’s business operations and reputation, introducing uncertainties and risks for investors holding MSFT stock.

Cybersecurity Threats:

In an increasingly digital world, cybersecurity threats pose risks to Microsoft’s operations and customer trust, potentially impacting its financial performance and investor sentiment towards MSFT stock.

Best Strategies To Implement While Investing In Msft Stock – Must Follow!

Diversification:

Diversifying your investment portfolio beyond MSFT stock helps mitigate risk and maximise returns, allowing you to spread investment across different asset classes and industries.

Long-Term Perspective:

Adopting a long-term investment perspective with MSFT stock allows investors to ride out short-term fluctuations and capitalise on Microsoft’s growth potential and market leadership over time.

Stay Informed:

Keeping abreast of Microsoft’s latest developments, earnings reports, and industry trends enables investors to make informed decisions and adjust their investment strategies accordingly.

Risk Management:

Implementing risk management techniques, such as setting stop-loss orders and diversifying across different sectors, helps protect investment capital and mitigate potential losses associated with MSFT stock.

Frequently Asked Questions:

How does Fintechzoom MSFT Stock benefit investors?

Investing in MSFT stock offers potential for consistent growth, dividend income, and exposure to a leading technology firm renowned for innovation and market dominance.

How does Microsoft’s cloud computing dominance impact MSFT Stock?

Microsoft’s leadership in cloud services, particularly with Azure, can drive revenue growth and bolster MSFT stock performance as businesses increasingly adopt cloud solutions for their Operations.

What role does Microsoft’s product diversification play in MSFT Stock’s resilience?

Microsoft’s diverse product portfolio, spanning software, hardware, cloud services, and gaming, contributes to MSFT stock’s stability by mitigating risks associated with dependence on specific markets or products.

How do global economic conditions influence MSFT Stock performance?

MSFT stock may be affected by macroeconomic factors such as GDP growth, interest rates, and currency fluctuations, as Microsoft operates in multiple countries and is exposed to global Economic trends.

Conclusion:

Fintechzoom MSFT Stock symbolises ownership of Microsoft Corporation’s shares traded on various stock exchanges. Investors hold stakes in Microsoft, recognised for its software, cloud services, and hardware offerings.

Read Also: