Fintechzoom Personal Loans – The Detailed Guide!

Navigating through financial challenges can feel like sailing through rough waters. I’ve been there, searching for the proper lifeline to stay afloat. That’s when I discovered Fintechzoom Personal Loans – a beacon of financial support that helped me weather unexpected storms and pursue my dreams.

Fintechzoom Personal Loans offer flexible funds for various needs. Simply apply online, meet the criteria, and get funds swiftly. Easy and convenient!

What Are Fintechzoom Personal Loans? – Know Briefly!

Fintechzoom Personal Loans are financial products designed to give individuals access to funds for various needs. These loans offer flexibility and convenience, making them suitable for various purposes. Whether you need to cover unexpected expenses, consolidate debt, or finance a significant purchase, Fintechzoom Personal Loans can help.

These loans typically come with fixed or variable interest rates, allowing borrowers to choose the option that best suits their financial situation. Additionally, Fintechzoom Personal Loans offer flexible repayment terms, allowing borrowers to tailor their loan payments to fit their budget and timeline. This flexibility ensures borrowers can manage their finances effectively and repay the loan on terms that work for them.

Fintechzoom Personal Loans are available online, making the application process simple and convenient. Borrowers can apply from the comfort of their homes and receive approval quickly, often within a matter of days. With minimal paperwork and hassle-free processing, Fintechzoom Personal Loans provides a streamlined solution for individuals seeking financial assistance. Whether facing unexpected expenses or planning for the future, Fintechzoom Personal Loans offer a reliable and accessible option for achieving your financial goals.

Read Amazon Stock Fintechzoom – Everything You Need To Know!

How Do Fintechzoom Personal Loans Work? – Guide For You!

1. Application Process:

- Start by visiting the Fintechzoom website and filling out the online application form for a personal loan.

2. Provide Information:

- Input personal and financial details such as income, employment history, and desired loan amount.

3. Credit Check:

- Fintechzoom will conduct a credit check to assess your creditworthiness and determine the terms of your loan.

4. Loan Approval:

- Once your application is processed and approved, you’ll receive a loan offer outlining the terms, including the interest rate, loan amount, and repayment schedule.

5. Acceptance:

- Review the loan offer carefully and accept the terms if they align with your financial goals and budget.

6. Funds Disbursement:

- After accepting the loan offer, the funds will be disbursed to your designated bank account, usually within a few business days.

7. Repayment:

- Repay the loan according to the agreed-upon schedule, making monthly payments that include principal and interest components.

8. Account Management:

- Manage your loan account online through the Fintechzoom website or mobile app, where you can track payments, view statements, and access customer support if needed.

9. Completion:

- Once you’ve made all scheduled payments, your Fintechzoom personal loan will be fully repaid, and you’ll have successfully fulfilled your financial obligation.

Eligibility Criteria For Fintechzoom Personal Loans – Must Know Before Applying!

- Credit Score:

Fintechzoom typically requires a minimum credit score for personal loan approval. A higher credit score indicates lower credit risk and increases your likelihood of approval.

- Income Stability:

Lenders often assess your income stability to ensure you have the financial capacity to repay the loan. They may require proof of income, such as pay stubs or tax returns, to verify your earnings.

- Employment Status:

Having a stable job or a reliable source of income is crucial for loan approval. Lenders may require proof of employment or steady income to assess your ability to repay the loan.

- Debt-to-Income Ratio:

Lenders evaluate your debt-to-income ratio, which compares your monthly debt payments to your gross monthly income. A lower debt-to-income ratio indicates lower financial strain and improves your chances of loan approval.

- Age and Residency:

You must meet the minimum age requirement set by Fintechzoom and be a legal resident of the country where you’re applying for the loan.

- Credit History:

Lenders consider your credit history, including your payment history, outstanding debts, and length of credit history. A favorable credit history demonstrates responsible financial behavior and increases your eligibility for favorable loan terms.

- Collateral (if applicable):

Fintechzoom may require collateral to secure the loan, depending on the loan amount and terms. Collateral can be in assets such as a car or a savings account.

Application Process For Fintechzoom Personal Loans – The Complete Procedure!

Applying for Fintechzoom Personal Loans is a straightforward process that can be completed online. Here’s the complete procedure:

Firstly, visit the Fintechzoom website and navigate to the personal loans section. You’ll find an online application form you must fill out with accurate and up-to-date information. The application form typically requires your name, address, contact information, employment status, income details, and desired loan amount.

Double-check the information once you’ve completed the application form to ensure accuracy. Any errors or discrepancies could delay the processing of your loan application.

After submitting your application, Fintechzoom will review your information and assess your eligibility for a personal loan. This process may include a credit check to evaluate your creditworthiness and determine the terms of your loan, including the interest rate and loan amount.

If your application is approved, you’ll receive a loan offer outlining the terms and conditions of the loan. Take the time to carefully review the offer, including the interest rate, repayment schedule, and any associated fees.

If you agree to the loan offer terms, you can proceed to accept it electronically. This indicates your agreement to the terms and confirms your intention to borrow the funds outlined in the loan offer.

Upon acceptance of the loan offer, Fintechzoom will disburse the funds to your designated bank account. The funds are typically deposited within a few business days, allowing you to access and use the money for your intended purpose.

Throughout the loan term, you’ll be responsible for making timely payments according to the agreed-upon schedule. You can manage your loan account online through the Fintechzoom website or mobile app, where you can track payments, view statements, and access customer support if needed.

Read Fintechzoom Careers – Explore Openings!

Interest Rates And Terms Of Fintechzoom Personal Loans – Know To Get!

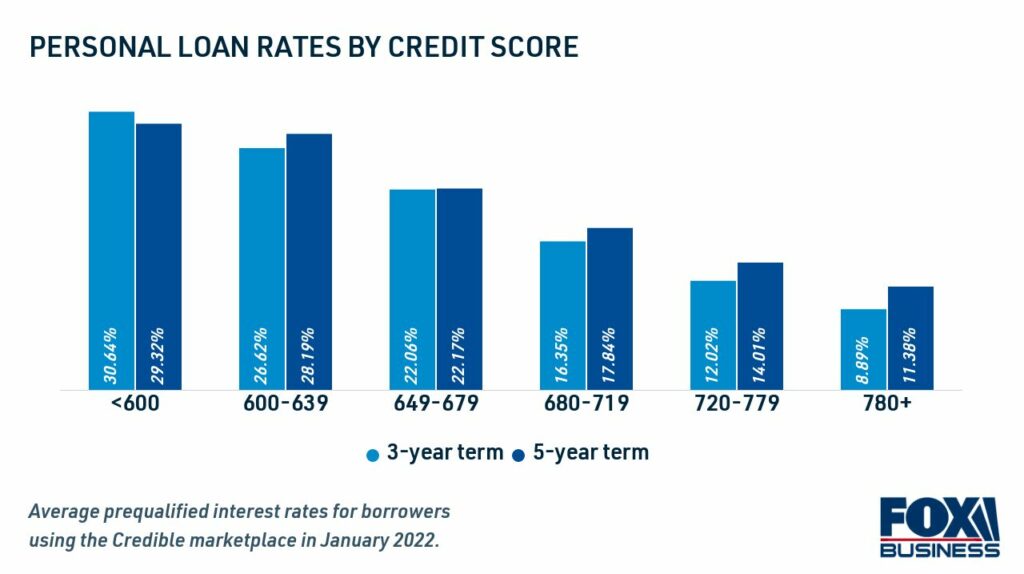

Fintechzoom Personal Loans offer competitive interest rates and flexible terms to suit borrowers’ needs. The interest rates vary depending on the borrower’s creditworthiness, loan amount, and repayment term.

Generally, borrowers with higher credit scores may qualify for lower interest rates, while those with lower scores may face higher rates. Additionally, Fintechzoom offers flexible repayment terms, allowing borrowers to choose repayment periods that align with their financial goals and budget.

Moreover, it’s essential to carefully review the interest rates and terms before accepting a loan offer to ensure it fits within your budget and financial situation.

Read Fintechzoom Qqq Stock Prediction – Know In Detail!

Benefits Of Choosing Fintechzoom Personal Loans – The Significance Revealed!

Fintechzoom Personal Loans offer numerous benefits, making them a preferred choice for borrowers seeking financial assistance. One significant advantage is their flexibility regarding loan amounts and repayment terms. Borrowers can choose loan amounts that suit their needs and budgets and select repayment terms that align with their financial goals.

Moreover, Fintechzoom Personal Loans often come with competitive interest rates, making them an affordable option for borrowing. Whether you’re consolidating debt, covering unexpected expenses, or financing a major purchase, the lower interest rates can help save money over the life of the loan.

Another critical benefit of Fintechzoom Personal Loans is the quick and convenient application process. With an online application platform, borrowers can apply for loans from the comfort of their homes and receive decisions promptly. This streamlines the borrowing experience and provides access to funds when needed most.

Furthermore, Fintechzoom offers excellent customer service and support throughout the loan process. From application to repayment, borrowers can rely on Fintechzoom’s dedicated team to promptly address any questions or concerns. This level of customer service enhances the overall borrowing experience and ensures transparency and satisfaction for borrowers.

In summary, the benefits of choosing Fintechzoom Personal Loans extend beyond just access to funds. They offer flexibility, affordability, convenience, and excellent customer service, making them a reliable and preferred option for individuals seeking financial assistance.

Tips For Managing Fintechzoom Personal Loans Responsibly – Here To Know!

- Budget Wisely: Create a budget that includes loan payments to ensure you can afford them without sacrificing other financial obligations.

- Stay Organized: Keep track of loan statements, payment due dates, and other relevant information to avoid missed payments or late fees.

- Prioritize Payments: Make loan payments a priority to avoid defaulting on the loan and damaging your credit score.

- Consider Automatic Payments: Set up automatic payments to ensure payments are made on time each month, reducing the risk of late fees and penalties.

- Communicate With Lender: If you encounter financial difficulties or anticipate difficulty making payments, contact Fintechzoom promptly to discuss potential solutions or payment arrangements.

Frequently Asked Questions:

What documents do I need to apply for a Fintechzoom Personal Loan?

Generally, you’ll need ID proof, income details, and other personal information for the application process.

How long does it take to get approved for a Fintechzoom Personal Loan?

Approval times vary, but many applicants receive decisions within a few business days.

Can I choose my repayment schedule for a Fintechzoom Personal Loan?

Yes, Fintechzoom often offers flexible repayment options to suit your financial situation.

What happens if I miss a payment on my Fintechzoom Personal Loan?

Missing payments may result in late fees or negatively impact your credit score, so staying on track is essential.

Can I pay off my Fintechzoom Personal Loan early?

Yes, you can pay off your loan early without penalty, saving on interest costs.

Are Fintechzoom Personal Loans available for people with bad credit?

Fintechzoom considers various factors, so getting a personal loan is possible even with less-than-perfect credit, though terms may differ.

Conclusion:

Fintechzoom Personal Loans provide versatile financing solutions for diverse needs. Just apply online, meet the requirements, and receive funds promptly. It’s hassle-free and convenient!

Read Also: