Hsi Fintechzoom – The Safe Investment!

As I sat glued to my screen, navigating through the tumultuous waves of financial markets, one term echoed louder than the rest: “HSI Fintechzoom.” It wasn’t just a keyword; it was my compass in the dizzying world of investments.

With each market fluctuation, it felt like I was riding the rollercoaster of my financial journey, seeking insights and guidance in the maze of data.

HSI Fintechzoom is a tool for tracking the Hang Seng Index, guiding my investment decisions with market insights and analysis.

The Hang Sang Index Overview – Detailed Introduction!

The Hang Seng Index (HSI) is a stock market index comprising significant companies listed on the Hong Kong Stock Exchange. It serves as a barometer for Hong Kong’s stock market performance and is widely used by investors to gauge market trends.

Established in 1969, the HSI includes companies from various sectors, such as finance, technology, and real estate. Its composition is reviewed regularly to ensure it reflects the dynamic nature of the market.

Investing in the HSI offers several advantages:

- It provides exposure to a diversified portfolio of leading Hong Kong companies, reducing the risk of investing in individual stocks.

- The HSI’s historical performance demonstrates its potential for long-term growth, making it an attractive option for investors seeking stability and capital appreciation.

- The HSI’s transparency and liquidity make it easy for investors to buy and sell shares, enhancing market efficiency and accessibility.

Advantages To Investing With Hsi – Know More!

Investing in the HSI through platforms like Fintechzoom offers numerous advantages. Firstly, it provides real-time market data and analysis access, empowering investors to make informed decisions.

Fintechzoom’s user-friendly interface and comprehensive tools enable investors to track the performance of HSI constituents, identify trends, and execute trades seamlessly.

Moreover, investing in the HSI via Fintechzoom allows diversification across asset classes and geographical regions, reducing overall portfolio risk.

Another significant advantage of investing with HSI and Fintechzoom is the opportunity for capital appreciation and dividend income. As the HSI constituents represent leading companies with strong growth potential, investors can benefit from stock price appreciation and regular dividend payouts.

Furthermore, Fintechzoom’s research reports and expert insights provide valuable guidance for investors, helping them navigate market uncertainties and capitalize on emerging opportunities. Investing with HSI and leveraging Fintechzoom’s resources can help investors achieve their financial goals effectively and efficiently.

Read: Fintechzoom Car Insurance – Avail Today!

The historical perspective – Dive in!

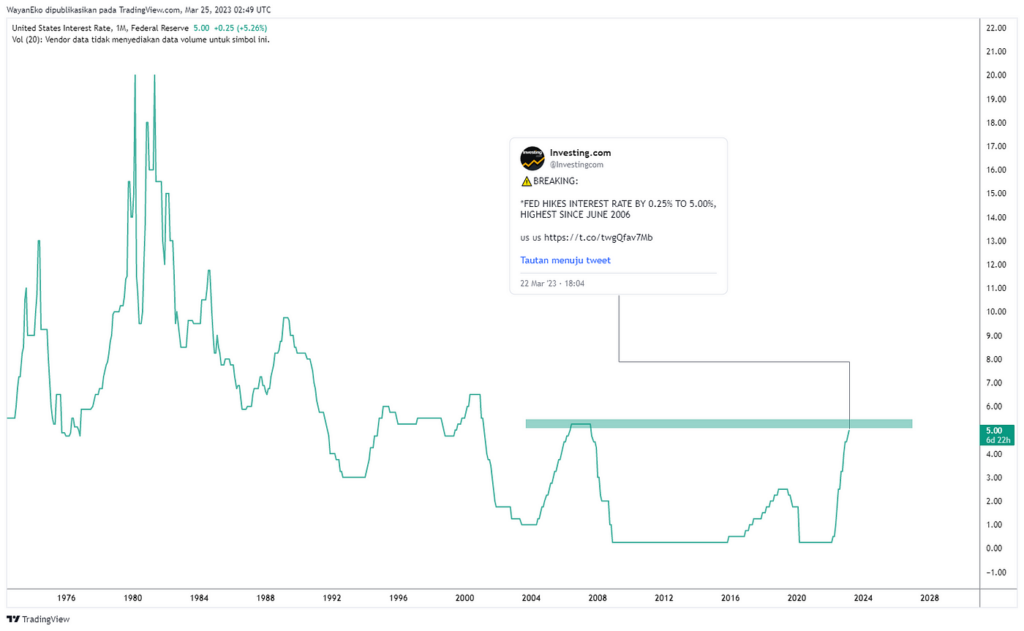

Let’s delve into its historical context to understand the Hang Seng Index’s significance. Established in 1969 by the Hang Seng Bank, the index started with a base value of 100 points.

Over the decades, it has become a crucial benchmark for Hong Kong’s stock market. Initially comprising only 33 constituents, the index now includes over 50 leading companies across various sectors, reflecting the dynamic nature of Hong Kong’s economy.

The HSI has weathered economic downturns, political uncertainties, and market fluctuations throughout its history. It has witnessed periods of rapid growth and resilience, demonstrating its adaptability to changing market conditions.

The index’s historical performance is a testament to Hong Kong’s economic prowess and role as a global financial hub. By studying past trends and milestones, investors gain valuable insights into market dynamics and potential future developments.

The essential components of hsi:

The Hang Seng Index comprises several essential components that drive its performance. These components represent diverse sectors of the Hong Kong economy, including finance, real estate, telecommunications, and technology.

Among the fundamental constituents are significant banks like HSBC Holdings and Hang Seng Bank, which play a pivotal role in Hong Kong’s financial landscape.

Additionally, companies from the property development sector, such as Sun Hung Kai Properties and CK Asset Holdings, contribute significantly to the index’s movement.

Other essential components include leading conglomerates like Tencent Holdings, which dominate the technology and internet services sector.

These companies’ market capitalization and trading volumes influence the index’s overall performance, making them crucial indicators of Hong Kong’s economic health.

Understanding the composition and weightage of these components is essential for investors seeking to analyze and interpret HSI movements effectively.

By closely monitoring these key players, investors can make informed decisions and capitalize on emerging opportunities in the Hong Kong stock market.

How hsi and fintechzoom are connected? – The Combination!

The connection between the Hang Seng Index (HSI) and Fintechzoom is rooted in accessibility and information dissemination. Fintechzoom serves as a platform that provides real-time updates, analysis, and insights into financial markets, including the HSI.

Through Fintechzoom, investors can access comprehensive data on HSI constituents, historical performance, and market trends.

This connection facilitates informed decision-making by empowering investors with the information they need to navigate the complexities of the stock market. Furthermore, Fintechzoom offers tools and resources that allow investors to track HSI movements, set alerts for price changes, and execute trades conveniently.

The seamless integration of HSI data into Fintechzoom’s platform enhances market transparency and accessibility, enabling investors to stay ahead of market developments.

The connection between HSI and Fintechzoom underscores the importance of technology in democratizing financial information and empowering investors of all levels to participate confidently in the stock market.

Different types of hang sang index – Explore the Diversity!

- Hang Seng China Enterprises Index

- Hang Seng China AH Index

- Hang Seng Composite Index

- Hang Seng Technology Index

- Hang Seng China H-Financials Index

- Hang Seng China H-Consumer Goods & Services Index

Some challenges that hsi fintech zoom face while trading:

Despite the advantages offered by HSI and Fintechzoom, there are several challenges that traders may encounter during trading activities. One significant challenge is market volatility, leading to rapid price fluctuations and increased risk exposure.

The interconnectedness of global markets and the impact of external factors such as geopolitical events and economic indicators contribute to market uncertainty, posing challenges for traders using HSI Fintechzoom.

Another challenge is information overload, as traders may need help to filter relevant data from the vast amount of information on Fintechzoom. The abundance of news, analysis, and market commentary can sometimes lead to confusion and indecision.

Additionally, technological glitches or disruptions in internet connectivity can impede traders’ ability to access real-time market data and execute trades efficiently. Overcoming these challenges requires a combination of risk management strategies, technological resilience, and disciplined trading practices.

Traders must stay vigilant, adapt to changing market conditions, and leverage the resources provided by HSI Fintechzoom to navigate challenges effectively.

Read: Fintechzoom Nvda Stock – The Detailed Guide!

Strategies To Positively Implement Hsi Fintechzoom:

Implementing HSI Fintechzoom effectively requires a combination of strategic approaches to maximize investment opportunities while managing risks. One key strategy is to conduct thorough research and analysis using the tools and resources available on Fintechzoom.

Traders can utilize technical analysis techniques to identify market trends, support, and resistance levels, helping them make informed trading decisions.

Additionally, staying updated with market news and developments enables traders to anticipate potential market movements and adjust their strategies accordingly.

Risk management is another crucial aspect of implementing HSI Fintechzoom successfully. Traders should establish precise risk tolerance levels and implement stop-loss orders to limit potential losses.

Diversifying investment portfolios across different asset classes and sectors can also mitigate risks associated with market volatility.

Regularly reviewing and adjusting investment strategies based on market conditions and performance metrics is essential for long-term success.

By adopting a disciplined and strategic approach to trading, investors can capitalize on HSI Fintechzoom’s opportunities while minimizing downside risks.

Hsi Impact On Global Economy – Over The World Influence!

The Hang Seng Index (HSI) has a significant influence on Hong Kong’s financial landscape and the global economy. As one of the leading benchmarks for the Asian financial markets, movements in the HSI can impact investor sentiment and market trends worldwide.

The index’s performance reflects broader economic conditions in Hong Kong and indicates regional economic health and stability.

Moreover, the composition of the HSI, which includes major companies from various sectors, offers insights into the overall strength and resilience of the global economy.

Changes in the HSI’s constituents and their market capitalization can signal shifts in consumer behaviour, technological innovation, and industry trends, influencing investment decisions globally.

Additionally, fluctuations in the HSI may impact international trade flows, currency exchange rates, and investor confidence, highlighting its interconnectedness with the broader global economic landscape. Understanding the HSI’s impact on the global economy is essential for investors and policymakers, as it provides valuable insights into emerging market trends and potential investment opportunities across borders.

Frequently Asked Questions:

Is the HSI the same as the stock market?

No, the HSI is just one way to measure how well the stock market is doing in Hong Kong.

Can the HSI predict future market trends?

While the HSI can give us clues about market trends, it can’t predict the future with certainty.

What does the HSI tell us about the stock market?

The HSI tells us whether the stock market is going up, down, or staying the same.

Conclusion:

HSI Fintechzoom helps me monitor the Hang Seng Index, providing valuable market insights and analysis to guide my investment decisions.

Read Also: