Nikkei225 Fintechzoom – The Best Investment To Must Go With!

Hey there, fellow investor! Are you keeping a close eye on the financial markets, especially the ever-dynamic world of fintech? If you’re like me, you’re likely intrigued by the fascinating intersection of finance and technology.

And guess what? Our spotlight today shines brightly on none other than Nikkei225 Fintechzoom – a fusion of Japan’s renowned stock index and the cutting-edge realm of financial technology.

Nikkei225 Fintechzoom combines Japan’s Nikkei 225 stock index and the fintech-focused platform Fintechzoom. It suggests an interest in tracking fintech-related developments within Japan’s financial markets, including cryptocurrency trends.

Read: Silver Price Fintechzoom Today – Everything You Need To Know!

What Is Nikkei225? – The History Revealed!

Nikkei225, also known as the Nikkei Stock Average, is Japan’s premier stock market index, measuring the performance of 225 top companies listed on the Tokyo Stock Exchange.

Established in 1950, it holds a prestigious status in the global financial landscape. The index reflects Japan’s economy’s overall health and trends, serving as a critical indicator for investors worldwide.

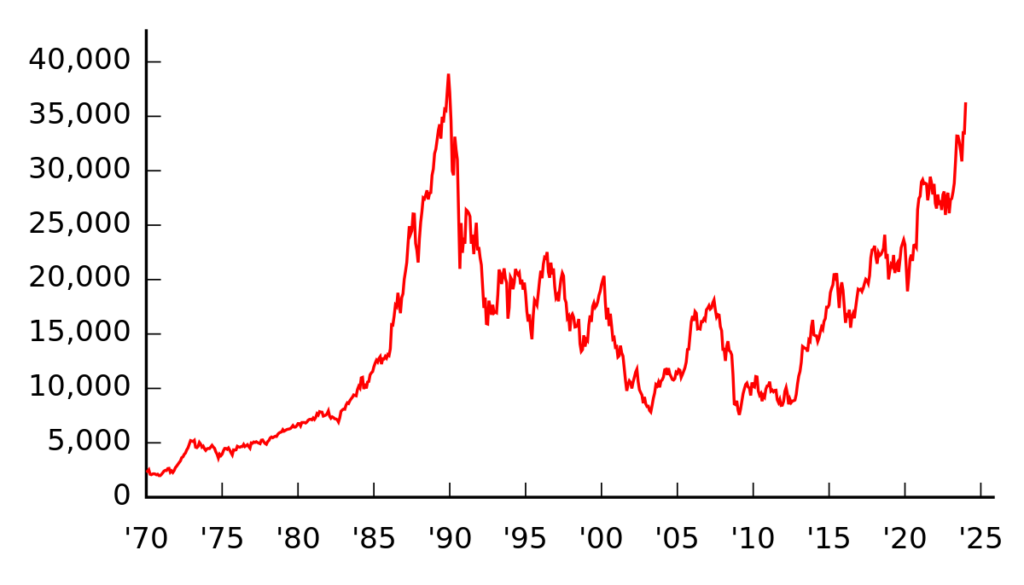

In its history, Nikkei225 has weathered various economic storms, including the Japanese asset price bubble in the late 1980s and subsequent economic downturns.

Notably, it reached its peak at the height of the bubble, only to experience a significant crash afterward. However, it has shown resilience over time, bouncing back and adapting to changing market dynamics.

Nikkei225’s composition includes companies from various sectors such as technology, automotive, finance, and manufacturing, offering a comprehensive snapshot of Japan’s industrial landscape.

Investors, analysts, and policymakers widely follow it for insights into market trends and economic conditions. Understanding the history and significance of Nikkei225 provides valuable context for navigating the complexities of Japan’s financial markets and global investment opportunities.

Key Benefits Of Investing In Nikkei225 Fintechzoom – Know Here!

Diversification Opportunities:

Investing in Nikkei225 Fintechzoom offers diversification benefits by gaining exposure to a broad range of industries and sectors represented in Japan’s stock market index. This diversification can help mitigate risks associated with investing in individual stocks.

Exposure to Fintech Innovation:

Nikkei225 Fintechzoom exposes investors to the innovative fintech sector within Japan’s economy. As technology continues to revolutionize the financial industry, investing in companies within this sector can offer opportunities for growth and potential returns

Access to Japan’s Market Dynamics:

By investing in Nikkei225 Fintechzoom, investors gain insights into Japan’s market dynamics and economic trends. Understanding Japan’s economic landscape is crucial for making informed investment decisions and capitalizing on emerging opportunities. To comprehend market dynamics, gain insights from the market research singapore.

Long-Term Growth Potential:

Historically, Nikkei225 has demonstrated long-term growth potential despite occasional market fluctuations. Investing in Nikkei225 Fintechzoom allows investors to participate in Japan’s economic growth trajectory over the long term.

Global Portfolio Diversification:

For investors seeking global portfolio diversification, Nikkei225 Fintechzoom offers exposure to one of the world’s largest and most influential economies.

Adding Japanese equities to a diversified investment portfolio can help spread risk and enhance overall portfolio stability.

The Major Components Of Nikkei225 – Explore Separately!

- Automobiles: Companies like Toyota, Honda, and Nissan are prominent components, reflecting Japan’s leading position in the automotive industry.

- Technology: Includes electronic giants such as Sony, Panasonic, and Canon, showcasing Japan’s innovation and expertise in technology.

- Finance: Major banks like Mitsubishi UFJ Financial Group and Sumitomo Mitsui Financial Group play a significant role in the index, representing Japan’s robust financial sector.

- Manufacturing: Companies like Toyota Industries and Hitachi contribute to the index, highlighting Japan’s strength in manufacturing and heavy industry.

- Retail: Retail giants like Fast Retailing (owner of Uniqlo) and Seven & I Holdings (owner of 7-Eleven) represent Japan’s vibrant retail sector.

- Telecommunications: Companies like NTT and SoftBank are key components, reflecting Japan’s advanced telecommunications infrastructure.

- Healthcare: Pharmaceutical companies such as Takeda Pharmaceutical and Astellas Pharma showcase Japan’s leadership in the healthcare industry.

- Energy: Energy companies like JXTG Holdings and Tokyo Gas represent Japan’s energy sector, including oil refining and gas distribution.

- Construction: Companies like Shimizu Corporation and Obayashi Corporation reflect Japan’s construction industry, essential for infrastructure development.

How To Invest In Nikkei225 Fintechzoom – Guide For You!

Investing in Nikkei225 Fintechzoom can be straightforward. First, you’ll need to open an investment account with a brokerage firm that offers access to Japanese stocks. Once your account is set up, you can start researching and analyzing the components of Nikkei225 Fintechzoom to make informed investment decisions.

One common way to invest in Nikkei225 Fintechzoom is through exchange-traded funds (ETFs) that track the index’s performance. ETFs offer the advantage of diversification, allowing you to invest in multiple companies within the index through a single investment vehicle.

Another option is to invest directly in individual stocks that are part of Nikkei225 Fintechzoom. This approach requires conducting thorough research on individual companies, assessing their financial health, growth prospects, and exposure to the fintech sector.

Before investing, it’s essential to consider your investment goals, risk tolerance, and time horizon. Additionally, staying updated on market trends, economic indicators, and geopolitical developments can help you make informed investment decisions.

It’s also advisable to consult with a financial advisor or investment professional who can provide personalized guidance based on your financial situation and investment objectives.

Overall, investing in Nikkei225 Fintechzoom can be a rewarding way to gain exposure to Japan’s financial markets and the innovative fintech sector, potentially offering opportunities for long-term growth and portfolio diversification.

Read: Fintechzoom Cost Of Living – Probe Savings!

Some Key Strategies To Invest In Nikkei225 Fintechzoom Safely – Dive In To Learn!

1. Research and Due Diligence:

- Conduct thorough research on the components of Nikkei225 Fintechzoom and the overall market conditions in Japan.

- Evaluate individual companies’ financial health, growth prospects, and competitive positioning within the index.

2. Diversification:

- Spread your investments across sectors and industries in Nikkei225 Fintechzoom to reduce concentration risk.

- Consider investing in other asset classes or geographic regions to diversify your investment portfolio further.

3. Dollar-Cost Averaging:

- Implement a dollar-cost averaging strategy by investing a fixed amount of money at regular intervals, regardless of market fluctuations.

- This strategy helps mitigate the impact of short-term market volatility and allows you to accumulate shares over time at various price levels.

4. Risk Management:

- Set clear investment goals and establish risk management strategies to protect your capital.

- Consider implementing stop-loss orders or trailing stop orders to limit potential losses in case of adverse price movements.

5. Long-Term Perspective:

- Take a long-term perspective when investing in Nikkei225 Fintechzoom, focusing on the underlying fundamentals and growth potential of the companies within the index.

- Avoid reacting impulsively to short-term market fluctuations and stay committed to your investment strategy over time.

6. Stay Informed:

- Stay informed about macroeconomic trends, geopolitical events, and regulatory developments that may impact the Japanese financial markets.

- Regularly monitor news updates, financial publications, and market research reports to stay abreast of relevant information affecting your investments.

Some Risks To Invest In Nikkei225 Fintechzoom – Must Keep In Mind!

Market Volatility:

Nikkei225 Fintechzoom, like any other stock index, is subject to market volatility. Fluctuations in market sentiment, economic indicators, and geopolitical events can lead to rapid changes in stock prices.

Currency Risk:

Investing in Nikkei225 Fintechzoom exposes investors to currency risk, especially if their base currency differs from the Japanese yen. Exchange rate fluctuations can impact the value of investments denominated in foreign currencies.

Sector Concentration:

Nikkei225 Fintechzoom may have significant exposure to specific sectors, such as technology or finance. Concentration in certain sectors increases vulnerability to sector-specific risks, such as regulatory changes or technological disruptions.

Economic Factors:

Japan’s economy is influenced by various economic factors, including interest rates, inflation, and GDP growth. Economic downturns, recessionary periods, or stagnation can negatively impact the performance of Nikkei225 Fintechzoom components.

Political and Regulatory Risks:

Changes in government policies, regulations, or geopolitical tensions can affect investor sentiment and market stability. Political instability or regulatory interventions may lead to uncertainty and volatility in Nikkei225 Fintechzoom.

Liquidity Risk:

Some stocks within Nikkei225 Fintechzoom may experience low trading volumes or limited liquidity, making it challenging to buy or sell shares at desired prices. Illiquid markets can exacerbate price fluctuations and increase transaction costs.

External Events:

External events such as natural disasters, pandemics, or global financial crises can have far-reaching impacts on financial markets, including Nikkei225 Fintechzoom. Unforeseen events may disrupt business operations, supply chains, and investor confidence.

Frequently Asked Questions:

Is investing in Nikkei225 Fintechzoom suitable for all investors?

Like any investment, investing in Nikkei225 Fintechzoom carries risks and may not be suitable for all investors. They are considering your investment goals, risk tolerance, and financial situation before investing is essential. Consulting with a financial advisor can help determine suitability.

How often is Nikkei225 Fintechzoom rebalanced?

Nikkei225 Fintechzoom undergoes periodic rebalancing to reflect changes in the composition of the Nikkei 225 index and fintech-related trends. Rebalancing frequency depends on index methodology and market conditions.

What are the historical returns of Nikkei225 Fintechzoom?

Historical returns of Nikkei225 Fintechzoom can vary based on market performance, economic conditions, and sectoral trends. Investors should review historical data and consult financial experts for insights into potential returns.

Are there any tax implications associated with investing in Nikkei225 Fintechzoom?

Tax implications depend on investment structure, jurisdiction, and holding period. Investors should consult tax professionals to understand tax obligations, including capital gains taxes and dividend taxes, related to their investments.

Conclusion:

Nikkei225 Fintechzoom is a mix of Japan’s Nikkei 225 stock index and a fintech-focused platform called Fintechzoom. It shows an interest in following fintech-related changes in Japan’s financial markets, including cryptocurrency trends.

Read Also: