Top Technologies Shaping the Future of Fintech

In the ever-evolving landscape of fintech, innovative technologies drive unprecedented transformation and reshape how we manage, invest, and transact in the digital age. From artificial intelligence (AI) and blockchain to quantum computing and decentralized finance (DeFi), myriad cutting-edge technologies are at the forefront of revolutionizing the fintech industry.

In this blog, we delve into the top technologies that are shaping the future of fintech, exploring their potential to disrupt traditional financial services, enhance efficiency, and foster financial inclusion on a global scale. Join us as we embark on a journey to uncover the transformative impact of these technologies and their implications for the future of finance.

The growing digitalization in the banking sector has made it an increasingly popular career choice, attracting not only banking enthusiasts but also tech-savvy individuals keen on shaping technologies in finance. As banks adopt advanced technologies like AI, blockchain, and data analytics to enhance customer experience and streamline operations, the demand for professionals with fintech expertise continues to rise.

Pursuing a fintech programme equips individuals with the skills and competencies to navigate complex banking technologies. These programs offer financial technology, digital banking, cybersecurity, and regulatory compliance training, preparing graduates to innovate, develop, and implement cutting-edge solutions in the rapidly evolving fintech landscape.

What is Fintech?

Fintech, or financial technology, typically refers to the innovative use of technology for delivering the financial services more efficiently, securely, and inclusively. It encompasses various digital solutions, including mobile banking, payment apps, robo-advisors, blockchain-based cryptocurrencies, and peer-to-peer lending platforms.

Fintech revolutionizes traditional financial services by leveraging advancements in artificial intelligence, data analytics, and blockchain to streamline processes, enhance customer experiences, and democratize access to financial products and services.

From digital payments to investment management, fintech is reshaping the financial industry, driving innovation, and transforming individuals and businesses managing their finances in the digital age.

How to Get into Fintech?

To get into fintech, aspiring professionals should first understand the industry and develop relevant skills such as programming, data analysis, and knowledge of finance. Engaging in courses, workshops, and hands-on projects can help build expertise.

Networking with industry professionals in the field and seeking internships or entry-level positions with fintech companies or financial institutions can provide valuable experience.

Additionally, staying updated on fintech trends and emerging technologies is essential. By continually learning and gaining practical experience, individuals can position themselves for success in the dynamic and rapidly growing field of fintech.

Top technologies reshaping the fintech landscape

Artificial intelligence (AI) integration is set to drive substantial value generation, particularly within the financial sector. Banks and other financial institutions are embracing an AI-centric approach, positioning themselves to compete effectively against the growing presence of technology companies.

According to McKinsey, implementing generative AI technologies alone could contribute up to $4.4 trillion annually to the global economy.

Blockchain: Blockchain, a decentralized and distributed ledger technology that securely records transactions across the network of computers. Each block in the chain contains a cryptographic hash of the previous block, creating an immutable record of transactions.

Blockchain technology is widely used in cryptocurrencies like Bitcoin, but its applications extend to various industries, such asfinance, supply chain management, healthcare, and more.

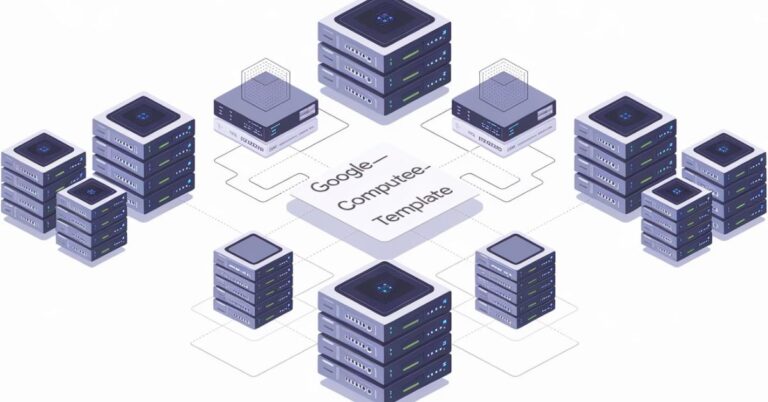

Cloud computing: Cloud computing typically involves the delivery of computing services—including storage, servers, databases, networking, software, and more—over the internet (“the cloud”). Cloud computing offers scalability, flexibility, cost-effectiveness, and accessibility compared to traditional on-premises infrastructure. It enables organizations to access resources on-demand, pay for what they use, and quickly scale up or down as needed, making it a popular choice for businesses of all sizes.

The Internet of Things (IoT): Internet of Things refers to the network of interconnected devices and objects that collect and exchange data over the internet. These devices can include sensors, smartphones, wearables, appliances, vehicles, and more. IoT technology enables the automation of processes, real-time monitoring, and data-driven insights across various domains, such as smart homes, smart cities, healthcare, agriculture, manufacturing, and transportation.

Open-source software, serverless architecture, and software as a service (SaaS): Open-source software refers to software with source code that is freely available for users to view, modify, and distribute. Serverless architecture involves building and running applications without managing servers, while Software as a Service (SaaS) delivers software applications over the internet on a subscription basis, eliminating the need for on-premises installation and maintenance.

No- and low-code development platforms: No-code and low-code development platforms enable users to build software applications with minimal coding knowledge or experience. These platforms provide visual interfaces, drag-and-drop tools, and pre-built templates to streamline the application development process, allowing users to create applications faster and more efficiently than traditional coding methods.

Hyper-automation: Hyper-automation involves the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and process mining to automate and optimize business processes end-to-end. By automating repetitive tasks, augmenting human capabilities, and enabling intelligent automation across organizations, hyper-automation aims to increase operational efficiency, improve decision-making, and drive innovation.

Fintechs shift toward sustainable growth

Due to new liquidity constraints, fintech companies are navigating a transformed landscape where prioritizing profitability over unrestrained growth has become imperative. In response, they are reevaluating strategies to ensure sustainability and resilience. According to McKinsey’s 2019 study, four pathways are projected to have the greatest impact:

Cost discipline: Implement rigorous cost control measures to adapt to the evolving funding environment while maintaining agility and compliance.

Stable growth: Prioritize measured expansion rooted in a solid core business with a proven market fit to scale operations sustainably.

Programmatic M&A: Strategically pursue mergers and acquisitions to foster beneficial partnerships and enhance value sharing with incumbents and fellow fintech firms.

Preserve culture: Safeguard the innovative and agile culture that underpins fintech disruption, fostering continued innovation and adaptability amidst industry shifts.

Conclusion

The top technologies shaping the future of fintech are poised to revolutionize the finance industry, driving innovation, efficiency, and customer-centricity. Embracing technologies such as blockchain, cloud computing, IoT, and hyper-automation offers unprecedented opportunities for fintech companies to transform financial services and create value in the digital age.

For aspiring professionals, undergoing a fintech programme is invaluable, providing the knowledge and skills needed to navigate this rapidly evolving landscape. These programs offer hands-on experience with cutting-edge technologies, insights into industry trends, and exposure to real-world applications, preparing individuals for rewarding careers in the dynamic and transformative field of finance.