C/H Accounting Credit Adjustment Fdes Nnf – Decode The Details!

Welcome to the intricate accounting world, where every credit, every debit, and every adjustment tells a story. In this article, we embark on a journey through the realms of C/H Accounting, exploring the nuanced art of credit adjustment within the framework of Financial Data Entry Systems (FDES) and the dynamic concept of NNF.

C/H Accounting Credit Adjustment refers to reconciling credits and debits in financial records. FDES, or Financial Data Entry Systems, integrates this adjustment with NNF (Net Net Foundation) to ensure accurate financial reporting.

So, fasten your seatbelts as we delve into the depths of this fascinating landscape where numbers come alive with meaning and significance.

Understanding C/H Accounting – The Brief Overview!

In the realm of accounting, understanding C/H Accounting is essential. C/H Accounting, also known as Cash and Accrual Basis Accounting, involves recording financial transactions based on when money is received or paid and when expenses are incurred, respectively.

This fundamental concept lays the groundwork for accurate financial reporting. By comprehending C/H Accounting, businesses can manage their cash flow, monitor expenses, and make informed financial decisions.

Moreover, it forms the cornerstone of sound financial management practices, guiding businesses in navigating the complexities of their financial operations.

Credit Adjustment In Accounting – Know More!

Credit adjustment plays a crucial role in maintaining the integrity of financial records. In accounting, credit adjustment involves reconciling discrepancies between credited and debited amounts to ensure accuracy in financial reporting.

This process is essential for identifying errors, rectifying discrepancies, and maintaining the overall reliability of financial data. Through credit adjustment, businesses can uphold transparency and accountability in their financial operations, fostering stakeholder trust.

Understanding the nuances of credit adjustment empowers businesses to mitigate financial risks and uphold compliance with regulatory standards.

Fdes In Accounting – Deciphering Details!

FDES, or Financial Data Entry Systems, are integral to modern accounting practices. These systems streamline the recording, storing, and analysis of financial data, enhancing efficiency and accuracy in accounting processes.

FDES encompass various software and technologies to facilitate seamless data entry, processing, and reporting. By deciphering the details of FDES, businesses can leverage technology to streamline their accounting operations, reduce manual errors, and gain insights for informed decision-making. Understanding the functionalities and capabilities of FDES empowers businesses to optimise their accounting processes and adapt to the evolving landscape of financial management.

Significance Of Credit Adjustment In Financial Data Entry Systems (Fdes) – The Importance Unveiled!

Credit adjustment holds immense significance within Financial Data Entry Systems (FDES), playing a pivotal role in ensuring the accuracy and reliability of financial records.

In FDES, credit adjustment serves as a critical mechanism for reconciling discrepancies between credited and debited amounts, thereby maintaining the integrity of economic data.

By meticulously reviewing and adjusting credit entries, businesses can identify and rectify errors, ensuring that financial reports reflect the actual financial position of the organisation.

Moreover, the significance of credit adjustment extends beyond mere error correction. It serves as a safeguard against financial fraud and misrepresentation.

Through diligent credit adjustment processes within FDES, businesses can detect anomalies and irregularities in financial transactions, mitigating the risk of fraudulent activities.

This proactive approach not only protects the organization’s assets but also upholds its reputation and credibility in the eyes of stakeholders.

Furthermore, credit adjustment in FDES enhances the efficiency and effectiveness of financial reporting processes. By automating credit adjustment procedures within FDES, businesses can streamline data entry, validation, and reconciliation tasks, reducing manual errors and accelerating the pace of financial reporting.

This efficiency gains particular importance in today’s fast-paced business environment, where timely and accurate financial information is critical for decision-making and strategic planning.

Read: Fintechzoom Msft Stock – The Best Cryptocurrency Guide For You!

Nnf In Credit And Debit Transactions – Explaining!

NNF, or Net Net Foundation, plays a crucial role in credit and debit transactions within the realm of accounting. Essentially, NNF represents the net effect of transactions after considering all relevant factors, including credits, debits, adjustments, and reconciliations.

In credit transactions, NNF reflects the net result of funds transferred or received, accounting for any adjustments or corrections made to the transaction. Similarly, in debit transactions, NNF provides insights into the net impact on financial accounts, taking into account both debits and credits.

Understanding NNF in credit and debit transactions is essential for maintaining the accuracy and integrity of financial records. By calculating NNF, businesses can ensure that their financial statements accurately reflect the net effect of transactions, thereby providing a clear and transparent picture of their financial position.

This enables stakeholders to make informed decisions based on reliable financial information, enhancing trust and confidence in the organization.

Furthermore, NNF serves as a valuable tool for financial analysis and reconciliation. By analyzing NNF trends over time, businesses can identify patterns, anomalies, and potential discrepancies in credit and debit transactions.

This insight allows for proactive measures to address issues promptly, preventing inaccuracies from snowballing into larger financial challenges.

Additionally, NNF facilitates reconciliation processes by providing a clear benchmark for comparing expected outcomes with actual results, streamlining the resolution of discrepancies and ensuring the accuracy of financial reporting.

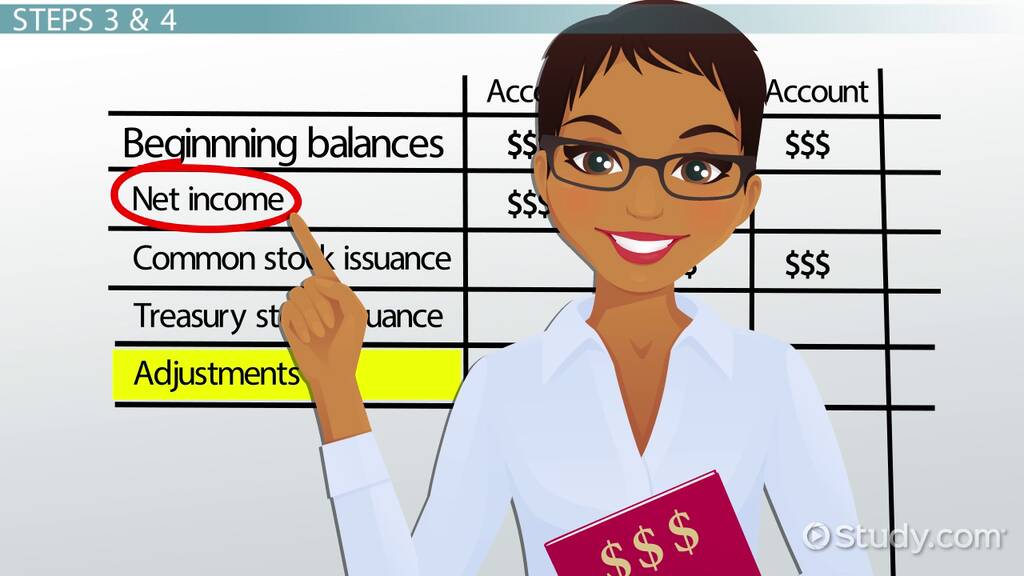

Impact Of C/H Accounting On Credit Adjustment – Know Here!

The impact of C/H (Cash and Accrual Basis) Accounting on credit adjustment is profound and far-reaching. C/H Accounting principles dictate how financial transactions are recorded, affecting the timing and recognition of credits and debits.

In C/H Accounting, transactions are recorded based on when cash is received or paid (cash basis) or when revenues are earned or expenses are incurred (accrual basis), significantly influencing credit adjustment processes.

For instance, under the accrual basis of C/H Accounting, revenue is recognized when it is earned, regardless of when cash is received. This principle necessitates adjustments to credit entries to ensure that revenues are accurately reflected in financial statements.

Similarly, expenses are recognized when they are incurred, requiring adjustments to debit entries to align with the matching principle.

Moreover, the impact of C/H Accounting on credit adjustment extends to compliance with regulatory standards and financial reporting requirements.

Adhering to C/H Accounting principles ensures that businesses accurately report their financial performance, thereby maintaining transparency and accountability to stakeholders.

Furthermore, the integration of C/H Accounting with credit adjustment processes enhances the reliability and relevance of financial information.

By aligning credit adjustment with C/H Accounting principles, businesses can generate financial reports that accurately reflect their financial position and performance, facilitating better decision-making and strategic planning.

Read: First National Realty Partners Pyramid Scheme – Details to Know Here!

Strategies For Effective Credit Adjustment In C/H Accounting – Explained For You!

Understanding C/H Accounting Principles:

- Familiarize yourself with the fundamental principles of C/H (Cash and Accrual Basis) Accounting.

- Recognize the implications of cash basis and accrual basis accounting on credit adjustment processes.

Maintaining Accurate Transaction Records:

- Implement robust systems for recording credit transactions promptly and accurately.

- Ensure thorough documentation of all relevant information, including dates, amounts, and transaction details.

Regular Reconciliation of Accounts:

- Conduct regular reconciliations of accounts to identify discrepancies and errors in credit entries.

- Compare recorded transactions with supporting documentation to ensure accuracy and completeness.

Adherence to Regulatory Standards:

- Stay abreast of regulatory requirements and accounting standards governing credit adjustment practices.

- Ensure compliance with relevant regulations to uphold transparency and accountability in financial reporting.

Proactive Error Detection and Correction:

- Implement processes for proactive error detection and correction in credit adjustment.

- Routinely review credit entries for inaccuracies or inconsistencies and take corrective action promptly.

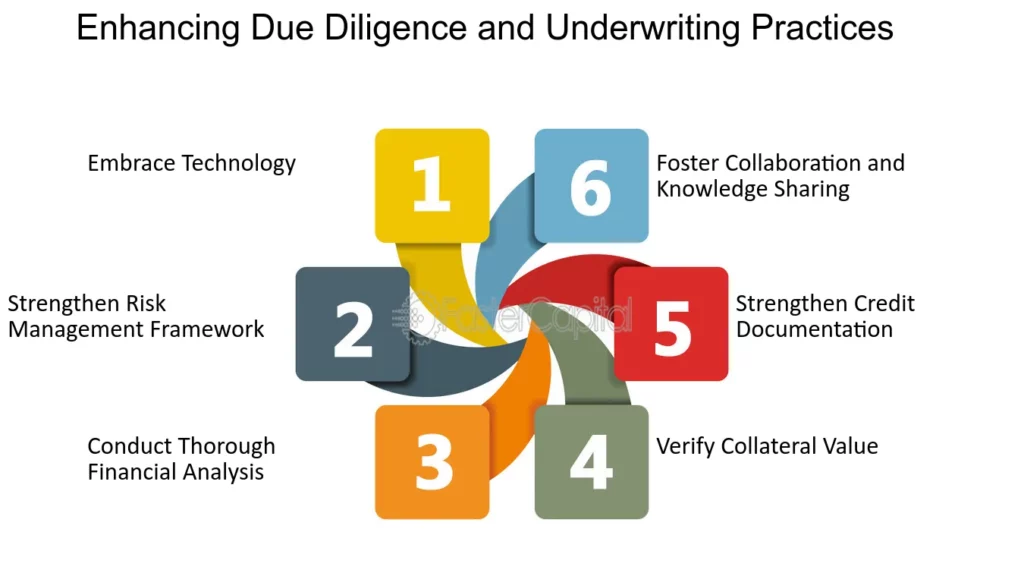

Utilization of Technology Solutions:

- Leverage accounting software and technology solutions to streamline credit adjustment processes.

- Implement automated systems for data entry, validation, and reconciliation to enhance efficiency and accuracy.

Cross-Functional Collaboration:

- Foster collaboration between accounting, finance, and other relevant departments to facilitate effective credit adjustment.

- Ensure clear communication and coordination to address issues and discrepancies in credit transactions promptly.

Continuous Training and Development:

- Provide ongoing training and development opportunities for staff involved in credit adjustment processes.

- Keep employees informed of best practices, regulatory updates, and technological advancements to enhance their skills and knowledge.

Monitoring and Performance Measurement:

- Establish key performance indicators (KPIs) to monitor the effectiveness of credit adjustment processes.

- Regularly assess performance against established KPIs and identify areas for improvement.

Documentation and Audit Trail:

- Maintain comprehensive documentation and audit trails for all credit adjustment activities.

- Ensure documentation is organized, accessible, and in compliance with audit requirements.

Challenges And Solutions In Nnf For Accounting Professionals – Must Know!

Navigating Net Net Foundation (NNF) poses several challenges for accounting professionals. One common challenge is the complexity of NNF calculations, especially in transactions involving multiple adjustments and deductions.

Accounting professionals may struggle to accurately determine the net impact of transactions, leading to errors in financial reporting. Additionally, ensuring consistency and reliability in NNF calculations across different accounting periods and transactions can be challenging.

Furthermore, interpreting NNF data requires a deep understanding of accounting principles and transactional nuances. Accounting professionals must possess advanced analytical skills to dissect NNF figures and derive meaningful insights for decision-making.

Moreover, staying updated with evolving accounting standards and regulations governing NNF adds another layer of complexity to the role of accounting professionals.

To address these challenges, accounting professionals can implement several solutions. Investing in advanced accounting software and technology solutions can streamline NNF calculations and automate repetitive tasks, reducing the risk of errors and improving efficiency.

Additionally, providing comprehensive training and development opportunities for accounting professionals can enhance their skills and proficiency in NNF analysis and interpretation.

Furthermore, fostering collaboration between accounting teams and other departments within the organization can facilitate knowledge sharing and problem-solving, enabling more effective NNF management.

Moreover, engaging external experts or consultants specializing in NNF can provide valuable insights and guidance on complex NNF issues.

By addressing these challenges proactively and implementing appropriate solutions, accounting professionals can navigate the complexities of NNF with confidence and ensure accurate and reliable financial reporting.

Best Practices For Nnf Integration In Credit Adjustment Processes!

Integrating Net Net Foundation (NNF) into credit adjustment processes requires careful planning and execution to optimize efficiency and accuracy.

One best practice is to establish clear guidelines and procedures for NNF integration, ensuring consistency and standardization across credit adjustment activities.

This includes defining roles and responsibilities, establishing workflow protocols, and documenting NNF calculation methodologies.

Additionally, leveraging advanced accounting software and technology solutions can streamline NNF integration into credit adjustment processes.

These tools can automate NNF calculations, facilitate data validation and reconciliation, and generate comprehensive reports to support decision-making. Moreover, integrating NNF calculations directly into credit adjustment software can enhance efficiency and minimize manual errors.

Furthermore, fostering collaboration between accounting and credit adjustment teams is essential for effective NNF integration. By facilitating communication and coordination between these departments, organizations can ensure alignment of NNF calculations with credit adjustment activities and enhance overall process efficiency.

Regular monitoring and performance measurement are also key best practices for NNF integration in credit adjustment processes. Establishing key performance indicators (KPIs) to track NNF accuracy, timeliness, and compliance can help identify areas for improvement and ensure ongoing optimization of NNF integration efforts.

Frequently Asked Questions:

What is C/H Accounting and how does it relate to credit adjustment?

C/H Accounting, or Cash and Accrual Basis Accounting, determines when transactions are recorded, influencing credit adjustments to ensure accurate financial reporting.

What role does Financial Data Entry Systems (FDES) play in credit adjustment?

FDES automates credit adjustment processes, facilitating efficient data entry, validation, and reconciliation to maintain the integrity of financial records.

What is NNF and why is it important in credit and debit transactions?

NNF, or Net Net Foundation, represents the net impact of transactions after adjustments, providing insights into the true financial position of an organization.

What challenges do accounting professionals face in managing NNF?

Accounting professionals may encounter challenges in complex NNF calculations and interpreting NNF data accurately amidst evolving accounting standards.

Conclusion:

C/H Accounting Credit Adjustment involves reconciling credits and debits in financial records. This process is integrated into Financial Data Entry Systems (FDES) and NNF (Net Net Foundation) to ensure precise financial reporting.

Read Also: