Dis Stock Fintechzoom – Detailed Investment Guide For You!

Investing in Disney stock through FintechZoom has been quite the journey for me. From the magical highs of witnessing the stock soar to new heights to navigating the twists and turns of its historical dips, my adventure with Disney stock has been a rollercoaster of financial magic.

Disney stock on FintechZoom has seen highs, hitting $193, with occasional dips. Since 1957, it is proven a reliable, growing investment despite short-term volatility.

Now, come and check for the details uncovered in this full length article.

Some Key Benefits Of Investing In Dis Stock Fintechzoom – Explored!

1. Historical Stability and Growth:

Investing in Disney stock through FintechZoom brings the allure of historical stability and steady growth. Since its public debut on the New York Stock Exchange in 1957, Disney stock has weathered various market storms, consistently demonstrating resilience.

Over the decades, the stock has transitioned from an initial price of around $1 per share to reaching a remarkable peak of $193 per share in 2021. This upward trajectory reflects Disney’s enduring success in entertainment, spanning animation, television, movies, and theme parks.

2. Dividends Amidst Volatility:

Despite occasional volatility, Disney stock offers dividends as a reassuring factor for investors. The company’s ability to navigate challenges and still provide returns to its shareholders is evident in its dividend payouts.

Even during challenging periods, such as the late 1990s and early 2000s, when the stock faced a significant dip due to animated film struggles, Disney managed to bounce back. This resilience, coupled with dividends, underscores the long-term value proposition for investors on FintechZoom.

3. Brand Strength and Future Potential:

Investors in Disney stock via FintechZoom benefit from the enduring strength of the Disney brand and its potential for future growth. The company’s prominence in the global entertainment industry, marked by its iconic characters and franchises, positions it favorably for continued success.

With ongoing expansion plans, acquisitions, and innovative ventures, Disney demonstrates a commitment to staying at the forefront of entertainment. This brand strength, combined with strategic business decisions, makes Disney stock a compelling option for investors seeking a blend of stability and growth potential on the FintechZoom platform.

What Is Dis Stock Fintechzoom – Uncover the Basics!

Disney stock on FintechZoom serves as a portal for investors into the dynamic realm of one of the entertainment industry’s giants. FintechZoom, a reputable platform for stock trading and investment, facilitates users’ engagement with Disney’s financial journey.

Since its introduction on the New York Stock Exchange in 1957, Disney stock has evolved into a pivotal component of numerous investment portfolios, offering a unique combination of historical stability and growth potential.

This avenue enables investors to partake in the success story of a company that has significantly impacted the global entertainment landscape.

Within the confines of FintechZoom, investors can explore the historical performance and trends that have molded Disney’s financial trajectory. From its modest origins with an initial stock price of around $1 per share to reaching a pinnacle of $193 per share in 2021, the stock’s trajectory reflects Disney’s enduring appeal and adaptability.

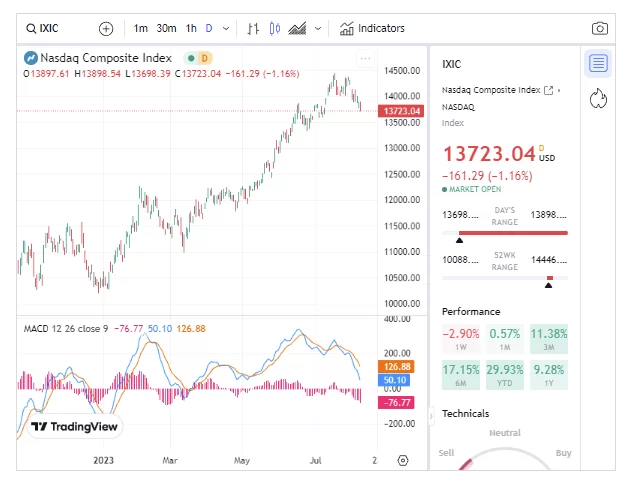

FintechZoom provides real-time data, charts, and analytics, empowering investors to comprehend the nuances of the stock. This information aids in making informed decisions, factoring in elements such as dividends, market fluctuations, and Disney’s strategic initiatives.

Moreover, FintechZoom presents a user-friendly interface, ensuring accessibility for investors to buy, sell, and monitor Disney stock seamlessly. The platform furnishes a wealth of information, encompassing historical stock prices, performance indicators, and pertinent news that may influence Disney’s stock.

Whether for novice or seasoned investors, FintechZoom functions as a valuable tool for navigating the intricacies of the stock market. With Disney stock on FintechZoom, investors not only secure a stake in a storied entertainment company but also leverage the convenience and insights provided by a leading fintech platform.

The Historical Outlook – Know the Cultural Significance!

Walking into the historical outlook of Disney stock is akin to taking a magical journey through the annals of entertainment history. Since its public listing on the New York Stock Exchange in 1957, Disney stock has become more than just a financial asset, it’s a cultural icon.

The stock’s journey mirrors the evolution of Disney as a global phenomenon, intertwining with the growth of animation, television, movies, and theme parks. From its humble beginnings with a nominal value of around $1 per share, Disney stock has transformed into a symbol of enduring success, reflecting the company’s ability to innovate and captivate audiences worldwide.

The cultural significance of Disney stock is rooted in the impact the company has had on popular culture. Disney’s timeless characters, beloved franchises, and groundbreaking achievements have transcended entertainment to become integral parts of our collective consciousness.

Investing in Disney stock on platforms like FintechZoom is not merely a financial decision; it’s a recognition of the cultural imprint that Disney has left on generations. The peak of $193 per share in 2021 represents not just a financial milestone but also a testament to the enduring magic that Disney continues to weave into the fabric of global culture.

As investors engage with Disney stock’s historical outlook, they connect not only with the financial narrative but also with the broader cultural narrative that has shaped the world of entertainment over the decades.

Some Factors That Influence The Dis Stock Fintechzoom – Know in Detail!

Economic Trends: One of the pivotal factors impacting Disney’s stock on FintechZoom is the prevailing economic landscape. Economic shifts, such as recessions or periods of growth, can influence consumer spending on entertainment, directly affecting Disney’s revenue streams from movies, theme parks, and merchandise.

Content Performance: The success of Disney’s content, spanning movies, TV shows, and streaming services, significantly influences its stock performance. Blockbuster releases and popular streaming platform engagement can contribute to increased investor confidence and stock value.

Theme Park Attendance: Disney’s theme parks play a vital role in its overall revenue. Factors like attendance numbers, consumer sentiment, and park expansions can impact the stock. High attendance often correlates with positive investor sentiment.

Competitive Landscape: The entertainment industry is highly competitive. Disney’s ability to navigate competition, secure intellectual property rights, and innovate in response to industry changes can sway investor perceptions and impact stock prices.

Regulatory Environment: Changes in regulations, especially regarding media and entertainment, can influence Disney’s stock. Regulatory approvals, restrictions, or changes in tax policies may have financial implications, impacting investor decisions.

The Journey Of Dis Stock Over The Years – Success Over the Time!

The journey of Disney stock over the years is a testament to the company’s enduring success in the dynamic landscape of the entertainment industry. Since its preliminary public supplying at the New York Stock Exchange in 1957, Disney inventory has traversed a exquisite trajectory.

Beginning with a modest value of approximately $1 per share, the stock embarked on an evolutionary odyssey marked by consistent growth. Through the decades, Disney strategically expanded its footprint across animation, television, movies, and theme parks, creating a diverse portfolio that contributed to its financial resilience.

As the years unfolded, Disney stock encountered various peaks and valleys, reflecting both internal and external dynamics. Notably, the stock reached its pinnacle at $193 per share in 2021, symbolizing a culmination of the company’s achievements.

Along the way, Disney faced challenges, including a significant dip in the late 1990s and early 2000s attributed to struggles in the animated film sector. However, the company’s ability to navigate these challenges showcased its resilience, bouncing back and maintaining a stock value well above historical averages.

The success of Disney stock over the years can be attributed to several factors. Disney’s unwavering commitment to storytelling, innovation, and brand-building has kept it at the forefront of global entertainment. Strategic acquisitions, such as Pixar, Marvel, and Lucasfilm, expanded the company’s intellectual property portfolio, contributing to its long-term success.

Moreover, Disney’s adaptability to industry trends, including the embrace of streaming services with Disney+, demonstrates its ability to stay relevant. Investors witnessing the journey of Disney stock unfold on platforms like FintechZoom not only engage with a financial narrative but also with the saga of a company that has mastered the art of storytelling, both on and off the stock market stage.

Some Risks Associated With Investing In Dis Stock – Avoid Some Factors!

Investing in Disney stock, while promising, comes with its set of associated risks that prudent investors should carefully consider. One prominent risk is the susceptibility of Disney’s revenue streams to economic downturns.

Economic contractions can lead to reduced consumer spending on entertainment, impacting Disney’s earnings from movies, theme parks, and merchandise. Additionally, the evolving landscape of the entertainment industry poses a risk.

Disney’s success is closely tied to the performance of its content, and any missteps or shifts in consumer preferences can affect the company’s stock value. Another risk factor lies in the competitive nature of the entertainment sector.

As Disney competes with other major players for audience attention, market share, and intellectual property, any failure to stay ahead of industry trends or secure valuable content rights could impact its competitive position and stock performance.

Furthermore, external factors such as regulatory changes or unforeseen global events can pose risks. Changes in regulations related to media or sudden geopolitical developments may have financial implications for Disney and its investors.

While Disney has demonstrated resilience over the years, investors should approach with caution, recognizing the inherent risks associated with market dynamics, industry competition, and external uncertainties. Diligent monitoring, informed decision-making, and a diversified investment strategy can help mitigate these risks and navigate the ever-changing landscape of the stock market.

Frequently Asked Questions:

1. What factors influence Disney stock prices?

Economic trends, Disney’s content performance, theme park attendance, competition, regulatory changes, and global events can impact Disney stock prices.

2. Does Disney stock pay dividends?

Yes, Disney pays dividends to its shareholders. It’s like a bonus payment, and you get a share of Disney’s profits, but not guaranteed.

3. How has Disney stock performed over the years?

Disney stock has shown growth over the years, reaching a peak of $193 per share in 2021. However, it also faced challenges, like a dip in the late 1990s.

4. Can I sell my Disney stock anytime I want?

Yes, you can sell your Disney stock on FintechZoom whenever the stock market is open. It’s like selling a possession when you need to.

Conclusion:

Disney stock, listed on FintechZoom, has experienced peaks, reaching $193, along with intermittent declines. Since 1957, it has demonstrated consistent growth, establishing itself as a dependable investment despite short-term fluctuations.

Read more: