The Impact of Your Credit Score on Remortgaging: How to Improve It

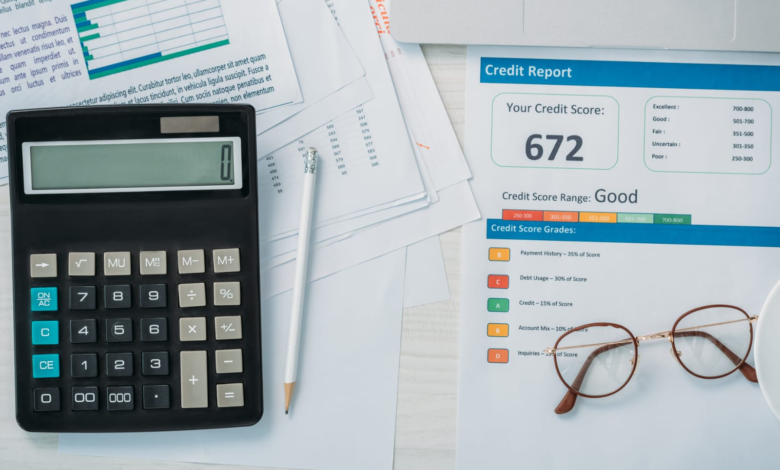

Remortgaging saves you money but comes with one scary risk —- your credit score impact. Credit score gives information about your finances. Thus, a high credit score can make it easier to secure a good remortgage deal.

But, what if your credit score doesn’t reflect the health of your finances? Take heart! Here is some remortgage advice for beefing up that score.

How Credit Scores Influence Remortgaging

Remortgage companies pull your credit report everytime you apply for a remortgage. In the report, they look at your finance management, debt, and if you pay your bills.

How frequently are you seeking credit? All these little details are factored into a three-digit score. An ideal score, hovering somewhere around 700, could make for the best deals.

A low score can result in higher interest rates, bad terms, or even rejection.

Steps to Check and Improve Your Credit Score

Check Your Credit Report

Ask for a credit report from the three main credit reference agencies to know your credit score. This report will detail your financial behavior.

Review it for errors that may be pulling down your score. Mistakes found? Notify the credit reference agency promptly.

Pay Down Debt

A high credit card balance can reduce your score even if you pay bills on time. Work on reducing expensive debts before applying for a remortgage.

Not only will this step improve your credit score. Reducing high debt can also improve that debt-to-income ratio. This makes you a more attractive remortgage borrower.

Correct Errors

Make sure your report accurately reflects everything you’ve done financially. Did you pay that bill on time?

Are those really your accounts? If you find a missed payment or account that isn’t yours, resolve it.

Avoid New Credit Inquiries

Credit companies do a hard inquiry on your credit report when you apply for credit. This means that you will have many inquiries if you apply for credit many times.

This, in turn, lowers your score. So skip the new credit card before applying for that remortgage.

The Ripple Effect of Different Credit Scores

Different scores can yield very different remortgage deals. For instance, an excellent credit score (720–850) can secure an interest rate of 2%.

On the other hand, a fair credit score (580–669) may get an interest rate of 4%. Over a 25-year term, this difference could spell $27,720. This is a significant sum!

Tips to Maintain a Healthy Credit Score

- Make every payment on time. You can set up auto-payments or reminders if you have a track record of forgetting.

- Use your credit wisely. Aim to use less than 30% of your available credit on your cards. This sends a message to potential lenders that you responsibly manage your credit.

- Show that you have experience with credit. Keep credit accounts open even if you no longer use them. Positive credit accounts with a longer history help your score.

- You can also consult experts on remortgage advice and how to help ensure your scores are good.

Wrapping Up

Getting approved for a remortgage is largely dependent on your credit score. It dictates the rates and terms that lending companies will offer.

The earlier you can start working to lift your score – the better your chance of getting a more favorable remortgage.